Hurun Future Unicorns in the World 2023

The Hurun Research Institute today released the Hurun Future Unicorns in the World 2023, a list of the world’s Gazelles, defined as start-ups founded in the 2000s, worth over US$500mn, not yet listed on a public exchange and most likely to ‘go unicorn’, ie hit a valuation of US$1bn, within three years. The Hurun Future Unicorns series is made up of Gazelles, this list here, most likely to ‘go uni

HURUN FUTURE UNICORNS IN THE WORLD 2023

IN SEARCH OF THE WORLD’S ‘GAZELLES’: START-UPS FROM THE 2000S WITH A VALUATION OF US$500MN TO US$1BN, NOT YET LISTED ON A PUBLIC EXCHANGE AND MOST LIKELY TO ‘GO UNICORN’ WITHIN 3YRS.

HURUN RESEARCH FINDS 688 GAZELLES IN WORLD, UP 163 OR 31% OVER LAST YEAR

USA RETAINED TOP SPOT WITH 247 GAZELLES, UP 23% OR 46 GAZELLES.

CHINA SECOND WITH 218, UP 27% FROM 171. BETWEEN THEM, USA AND CHINA HAVE 68% OF TOTAL GAZELLES IN WORLD.

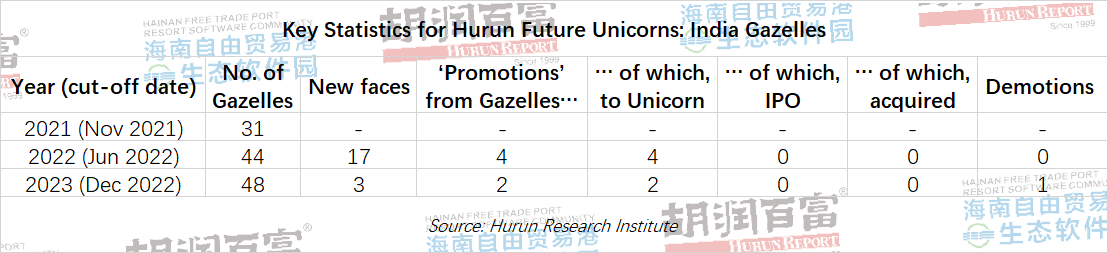

INDIA THIRD WITH 48, UP 19. UK 4TH WITH 42, UP 16

310 ‘NEW FACES’, INCLUDING cryptocurrency platform Elwood Technologies, founded by GENEVA-BASED British hedge fund billionaire Alan Howard.

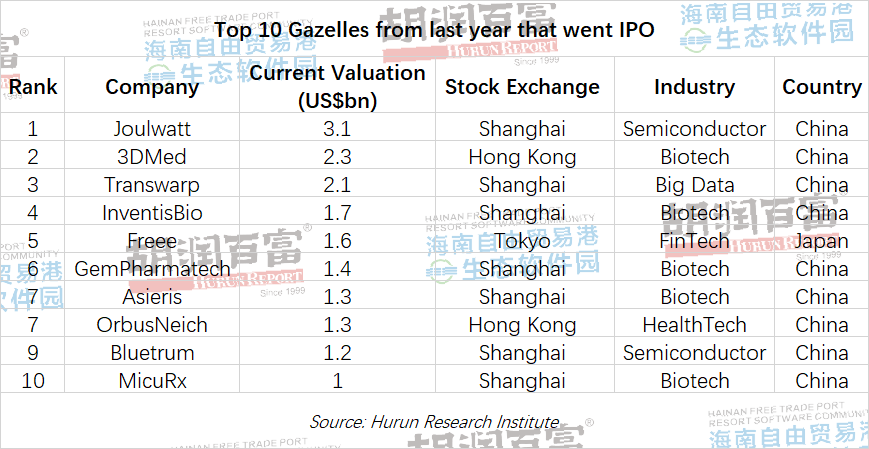

120 GAZELLES ‘PROMOTED’ TO UNICORNS OR WENT IPO. 9 OUT 10 MOST VALUABLE STARTUPS THAT WENT IPO FROM CHINA, LED BY SEMICONDUCTOR DESIGN STARTUP JOULWATT, BIOTECH STARTUP 3DMED AND BIG DATA STARTUP TRANSWARP.

38 ‘DEMOTED’, NO LONGER MAKING CUT

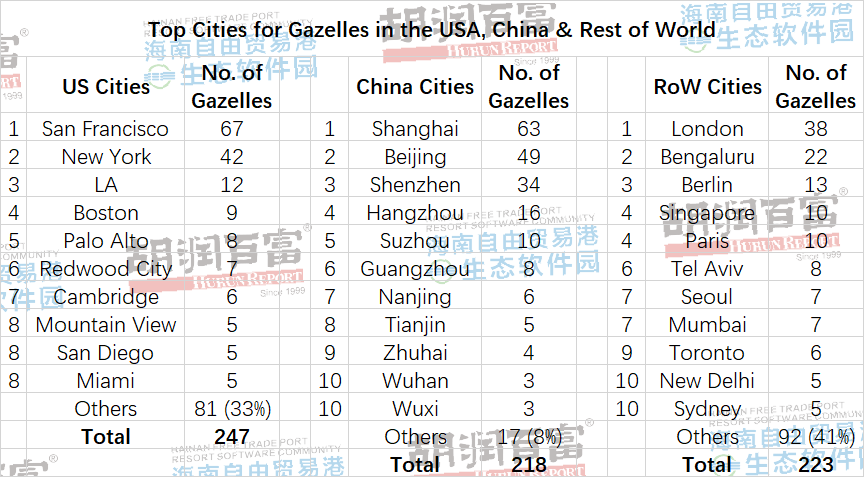

WITH 67 GAZELLES SAN FRANCISCO RETAINED TOP SPOT FOR CITIES WITH MOST GAZELLES, FOLLOWED BY SHANGHAI WITH 63, BEIJING 49 AND new york 42.

Austria, BAHRAIN, KENYA, KUWAIT and south africa HAD AT LEAST ONE gazelle for first time.

columbia broke into top twenty with two new gazelles: fintech addi and e-commerce TUL, BOTH BASED in bogota.

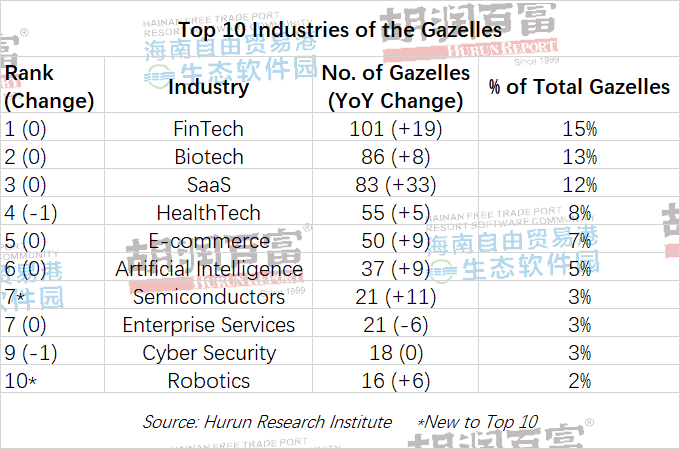

FINTECH LED WITH 101 GAZELLES, FOLLOWED BY BIOTECH 86, SAAS 83, HEALTHTECH 55 AND E-COMMERCE 50.

HEALTHCARE (147) most disrupted SECTOR BY GAZELLES, followed by FINANCIAL SERVICES (122) AND BUSINESS MANAGEMENT SOLUTIONS (107).

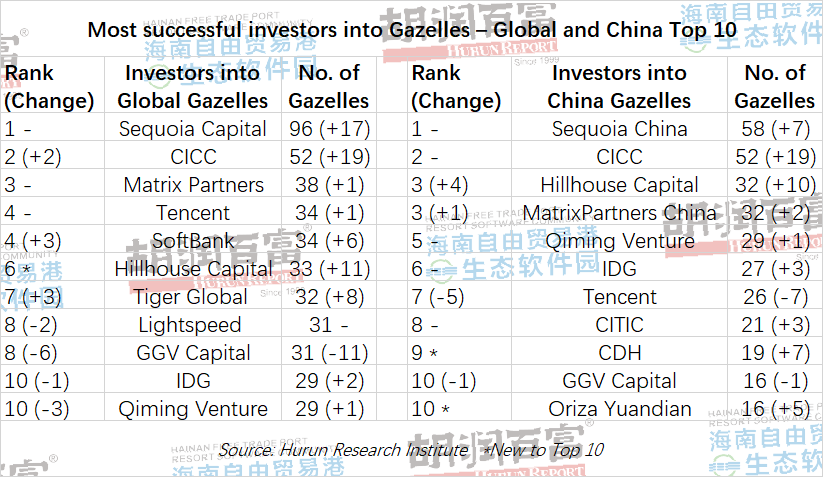

SEQUOIA WORLD’S MOST SUCCESSFUL GAZELLE INVESTOR, INVESTING INTO ONE IN SEVEN OF WORLD’S GAZELLES, FOLLOWED BY CICC, MATRIX PARTNERS, TENCENT AND SOFTBANK.

AVERAGE AGE OF HURUN GAZELLES 8 YRS. 37 OR 6% FOUNDED SINCE PANDEMIC.

(27 April 2023, Haikou, China & Mumbai, India) The Hurun Research Institute today released the Hurun Future Unicorns in the World 2023, a list of the world’s Gazelles, defined as start-ups founded in the 2000s, worth over US$500mn, not yet listed on a public exchange and most likely to ‘go unicorn’, ie hit a valuation of US$1bn, within three years. The Hurun Future Unicorns series is made up of Gazelles, this list here, most likely to ‘go unicorn’ within three years, and Cheetahs, most likely to ‘go unicorn’ within five years. The cut-off date used was 31 December 2022. This is the third edition of the list.

This report includes the Most Successful Gazelle Investors in the World 2022, a ranking of the top 50 investors, based on the number of Gazelles they have invested in.

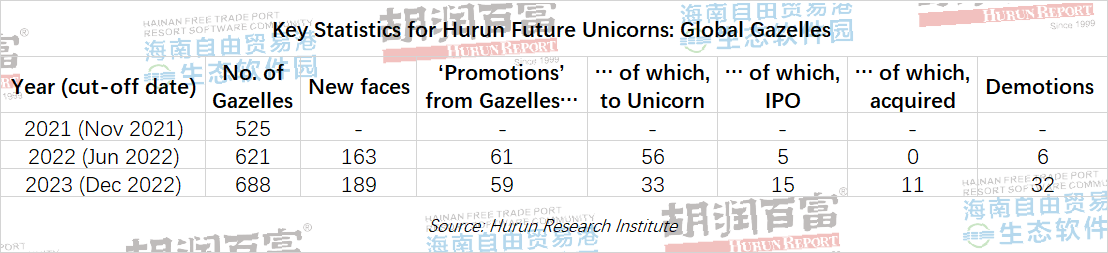

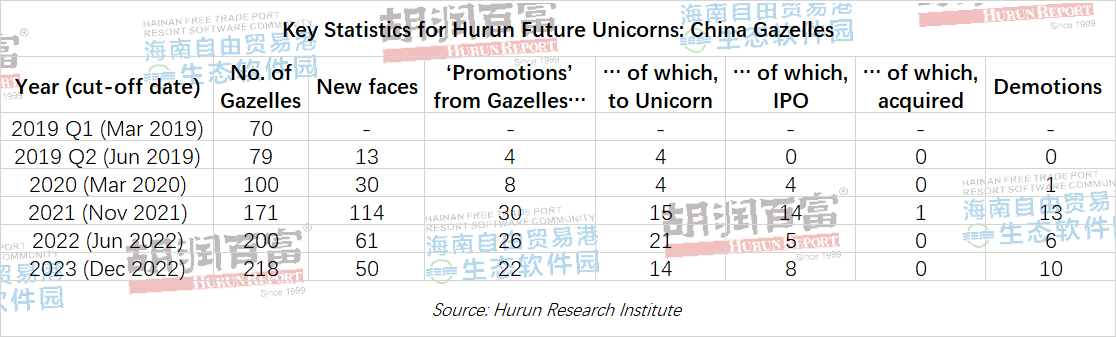

Hurun Research found 688 Gazelles in the world, up from 525 last year, based in 39 countries and 165 cities. 23% or 120 ‘promoted’ from last year’s index to unicorn status or acquired, whilst 7% or 38 were ‘demoted’, no longer making the cut. 367 from last year’s index still make the cut. There were 310 new faces, of which FinTech 44, SaaS 36 and Biotech 24, from China 101, the US 90 and India 26.

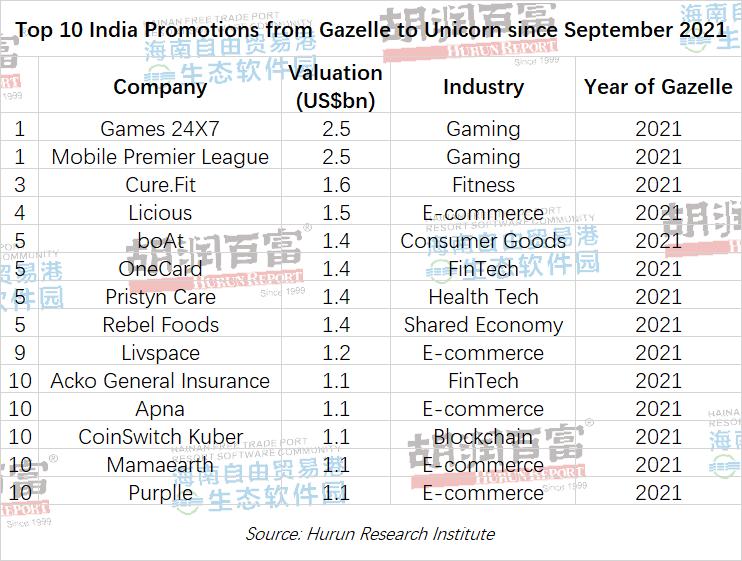

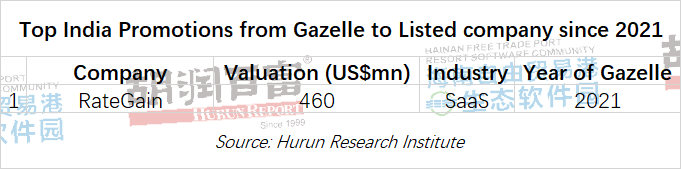

Of the 120 promotions, 89 went unicorn, 20 went IPO and 11 were acquired. 48 were from China, 38 from the USA and 6 from India. The main sectors were FinTech and BioTech with 16, followed by SaaS with 12.

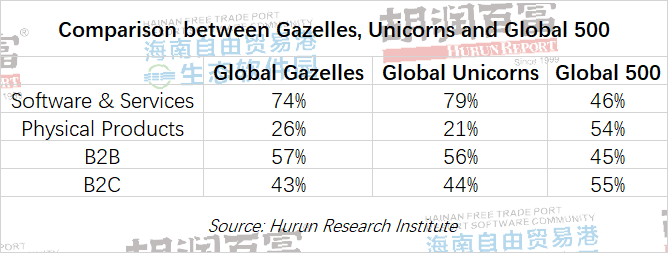

FinTech, Biotech and SaaS led, followed by HealthTech, E-commerce and AI. 74% sell software and services, with only 26% selling physical products. 57% sell to businesses, whilst 43% are consumer-facing. On average, they were set up in 2015.

Hurun Report Chairman and Chief Researcher Rupert Hoogewerf said: “The Hurun Future Unicorns: Global Gazelles Index is a comprehensive list of the world’s startups most likely to ‘go unicorn’ within three years. Gazelles provide an insight into the economy of tomorrow. What they are doing and where they are doing it gives an indication into which sectors are attracting the world’s top young talent and smartest capital, and which countries and cities have the best start-up ecosystems.”

“While rising interest rates and global uncertainties have dramatically reduced the appetite of investors to put money into startups in the past half year, there are nonetheless just under 700 companies, a new world record, that Hurun Research believes are most likely to ‘go unicorn’ within three years.”

“The three years since the pandemic have been a golden age for startups, with the number of known unicorns in the world tripling from 494 pre-Covid to 1361 today and a world record of just under 700 Gazelles.”

“The speed of value creation in the world’s most disruptive industries is remarkable. 37 Gazelles were founded since Covid began.”

“The slow-down in the economy has been tough for certain companies, with 7% of last years Gazelles dropping off the list because Hurun Research no longer believes they could go unicorn within three years. Rising interest rates and geopolitical headwinds have combined to make it harder for startups to raise capital.”

“The Hurun Future Unicorns: Global Gazelle Index is compiled using data from the world’s leading venture capitalists, making this perhaps the most comprehensive list of the world’s future unicorns.”

“The Hurun Future Unicorns: Global Gazelles Index is the pipeline of future unicorns, with 18% or 89 of the 508 new unicorns in the world coming from last year’s index. A further 2% of this year’s new unicorns came from the Hurun Future Unicorns: Global Cheetahs Index, meaning that between Hurun’s two future unicorn lists, we have identified a remarkable 20% of the world’s new unicorns this year. For China, we have managed to identify 40% of the 107 new unicorns in our Gazelles and Cheetahs lists. For India, it was higher still, hitting 80% of the 22 new unicorns.”

“The fastest-growing sectors of the year were SaaS, FinTech and Semiconductors, followed by AI, E-commerce, Biotech and Robotics. Overall, the world’s smartest money is betting on FinTech, Biotech and SaaS mainly, followed by HealthTech, E-commerce and AI.”

“The US and China’s start-up ecosystems are strong in quite different sectors, with US-based Gazelles doing SaaS, FinTech and HealthTech, and China’s doing Biotech, SaaS and Semiconductors. Gazelles from the Rest of the World are doing FinTech, E-commerce and SaaS.”

“Industries that have been most disrupted by Gazelles are Healthcare, Financial Services and Business Management Solutions.”

“The average age of the Hurun Gazelles is only eight years, suggesting that if you were to start-up today, you should aim to build a Gazelle by 2031! This list represents the best companies under a billion.”

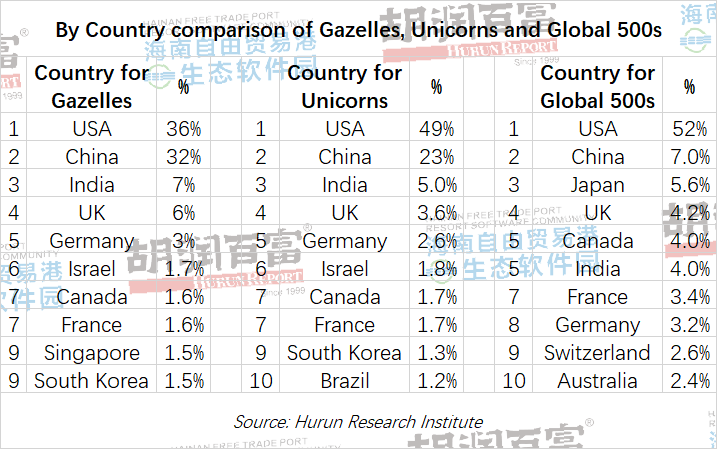

“Which countries are most likely to produce unicorns in the next three years? The US and China dominate with two thirds of the world’s known Gazelles, despite representing only a quarter of the world’s population. The rest of the world is currently led by India, the UK, Germany, Israel and Singapore.”

“Europe’s start-up ecosystem is picking up speed, with 16% of the world’s Gazelles. This suggests that Europe is going to add to its share of the world’s unicorns, currently standing at 11%.”

“A successful start-up ecosystem requires rolemodels, both individuals, such as those from the Hurun Rich Lists, and companies, such as those from the Hurun Global Unicorn and Hurun Global 500 most valuable companies series. If a city or country can attract the world’s most successful entrepreneurs and companies to set up shop there, that will have a roll-on effect. Entrepreneurship is infectious and cities with lots of rolemodels are likely to attract the brightest and best young entrepreneurs. It becomes a self-fulfilling prophesy.”

“The role of investors is evolving from just providers of cash to mentorship and scale-up opportunities. The world’s leading Gazelle venture capitalists are building ecosystems with their portfolios, hugely attractive to the world’s fastest-growing start-ups. Being able to say you have one of these brands as an investor adds significant credibility. Sequoia is the world’s most successful VC platform at finding and investing into Gazelles, followed by CICC, MatrixPartners, Tencent and SoftBank.”

“Some business models will have a ‘local winner’ in each region. VCs that invested into Gazelles across the largest spread of countries, were SoftBank, Goldman Sachs, Temasek and Sequoia.”

“What the Gazelles do gives an indication of the problems they are offering solutions to. In India, for example, quick commerce company Zepto, financial services start-up Viviriti Capital and EV space start-up Ather Energy are expected to play a critical role in solving credit, last mile logistics and renewable energy for India. In the US, companies Virgin Hyperloop and vehicle automation start-up Robotic Research are making an impact.”

“There is a clear trend towards serial entrepreneurs. The likes of Elon Musk has a Gazelle with Neuralink, three Unicorns with SpaceX, OpenAI and The Boring Company, as well as one of the Top 10 most valuable companies in the world, Tesla.”

“World-class universities are of critical importance to a successful start-up ecosystem. Stanford underpinned Silicon Valley’s early success, and today we are seeing deeper engagements of top universities with successful start-ups that – in turn – are fostering new generations of talent.”

“Hurun Report is committed to promoting entrepreneurship through its lists and research. Hurun’s ‘startup series’ has four main components. It begins with the Hurun U30s Entrepreneurs to Watch, a list of the top entrepreneurs under the age of 30. Next up are the two future unicorn lists: Hurun Cheetahs, most likely to ‘go unicorn’ within 5 years and currently with a valuation of between US$200 million and US$500 million, and Hurun Gazelles, most likely to ‘go unicorn’ within 3 years and currently with a valuation of between US$500 million and US$1 billion. The Hurun Global Unicorn Index is the pinnacle of the world’s start-ups.”

“I am delighted to release the Hurun Future Unicorns in the World 2023 in Hainan Island’s Haikou, inviting the world’s gazelles, investors and advisers to discuss innovation and entrepreneurship, new technologies and business models.”

Hainan is currently the world's largest free trade port with the greatest potential for growth. At present, Hainan has launched preparations for customs closure operations to fully deepen free and convenient trade, investment, cross-border capital flow, entry and exit of people, transportation from the island and safe and orderly flow of data, with the deployment of island-wide customs closure operations to be achieved by the end of 2025. As the frontier and window of China's reform and opening up, Hainan will become the new highland of China's open economy. At present, in the cultivation of unicorns, the Hainan Provincial Government has issued a "Special Action Plan for the Cultivation of Listed Companies", striving to add one to two new listed companies by 2025, cultivate 60 listed enterprises in reserve, and to actively build a cluster of the digital economy industry with international-level competitiveness.

Hainan Free Trade Port Resort Software Community (Hereinafter RSC) is the key platform that reaped the advance policy of Hainan Free Trade Port (Hereinafter FTP) in the early stage of the development of the digital economy in Hainan FTP. It will innovate the digital economy scenario track and nurture unicorns and listed companies through the trinity of "scenario + fund + policy" industry cultivation strategy. In the future, RSC will further unleash the advantages of the system innovation of Hainan FTP with the strong support of the government, invest material, human and financial resources to build digital technology, provide digital infrastructure for enterprises in addition to physical infrastructure, and play the leading role of industrial investment funds to cultivate enterprises through capital mergers and acquisitions and integrations.

Where are the World’s Gazelles based?

The world’s Gazelles come from 39 countries, up from 30 last year, spread around 165 cities, up from 134. Just over 150 countries in the world have no known Gazelle.

The USA and China led with 247 and 218 Gazelles, together accounting for 68% of the world’s known Gazelles.

India was third with 48 Gazelles, including quick commerce start-up Zepto, e-commerce start-up Turtlemint, and FinTech start-up Vivriti Capital. India is the fastest-growing country in the world for Gazelles, after China and the US.

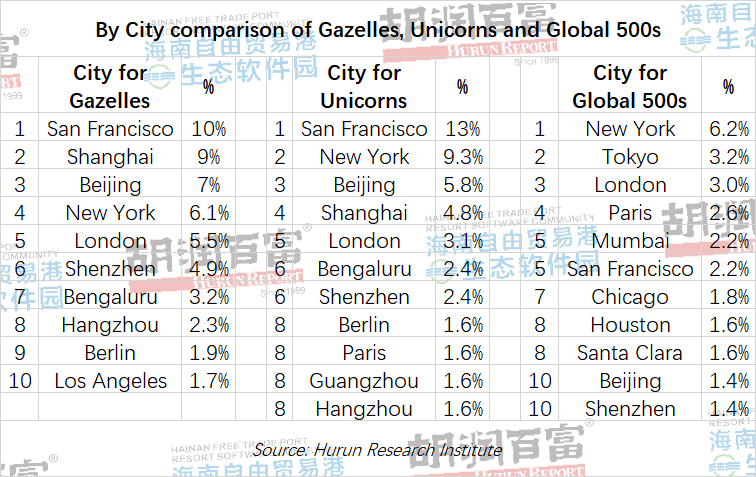

By city, San Francisco and Shanghai are the world’s Gazelle capitals with 67 and 63, followed by Beijing and New York.

London is the Gazelle capital of Europe with 38 Gazelles, more than Berlin, Paris, Munich and Zurich combined.

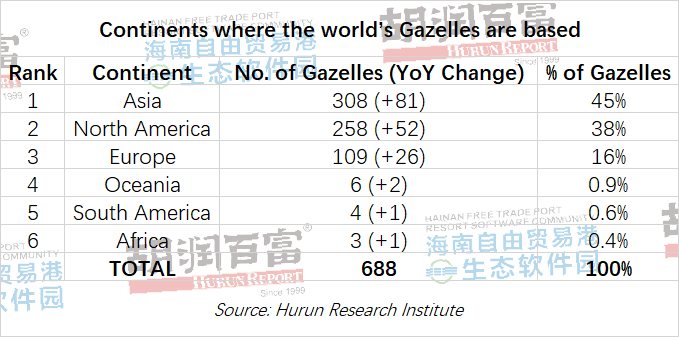

Asia led North America as the continent creating the most Gazelles in the world.

What industries do they come from?

The fastest-growing sectors of the year were SaaS, Fintech and Semiconductors, followed by AI, E-commerce, Biotech and Robotics.

Overall, FinTech, BioTech and SaaS led, followed by HealthTech, E-commerce and AI.

The main sectors of US-based Gazelles were SaaS, FinTech and Health Tech, for China it was Biotech, SaaS and Semiconductor, whilst for the Rest of the World, it was FinTech, E-commerce and SaaS.

74% sell software and services, led by FinTech, SaaS, E-commerce and HealthTech, with only 26% selling physical products, led by BioTech, Medical Equipment, Semiconductors and Robotics.

Traditional industries most disrupted by Gazelles were Healthcare with 147 Gazelles followed by Financial Services and Business Management Solutions.

Gazelles ‘promoted’ or ‘demoted’?

Overall, 23% of last year’s list was promoted and 7% demoted.

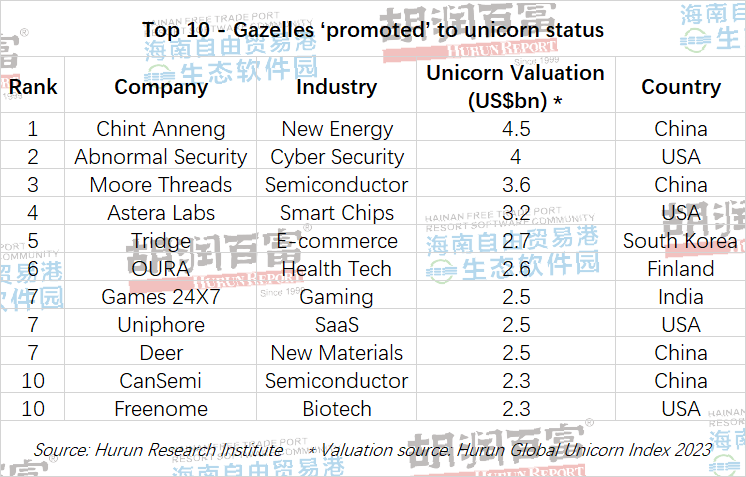

120 companies were promoted from last year’s Gazelle list, with 89 ‘going unicorn’, 20 going IPO and 11 acquired. Of the 120 promoted gazelles, 48 were from China, 38 from the USA, and 6 from India. The main sectors of promoted gazelles were FinTech and BioTech with 16, followed by SaaS with 12.

Hangzhou-based Joulwatt, from last year’s Gazelle index, was the most valuable IPO, with a current market cap of US$3.1bn. Julwatts designs integrated circuit technology for LED lighting and battery management applications. Shanghai-based oncology precision medical testing services 3DMed is worth US$2.3bn and database developer Transwarp is worth US$2.1bn.

Promotions to the Hurun Global Unicorns Index 2023 were led by Hangzhou-based rooftop renewable energy equipment Chint Anneng Digital Power, which grew to a valuation of US$4.5bn. San Francisco-based AI-based cloud email security platform Abnormal Security is worth US$4bn and Beijing-based GPU technology and services start-up Moore Threads is worth US$3.6bn.

Shangha-based fashion brand trading platform Dewu has been the most successful Gazelle, since Hurun Research started tracking Gazelles in 2019. Dewu today has a valuation of US$10bn, and was one of the fastest growing unicorns in the world this year. Another was Guangzhou-based autonomous driving technology startup Weride, currently worth US$5bn.

Zhongshan-based biopharmaceutical start-up Akesobio has had the the most successful IPO of any Hurun Gazelle, since Hurun Research started tracking Gazelles in 2019. Today Akesobio has a market cap of US$4.6bn. Shanghai-based semiconductor startup ASR Microelectronics and Beijing-based robot vacuum maker Roborock both have a valuation today of US$4.3bn. Beijing-based Medbanks, a provider of data processing services to the healthcare industry, has a market cap of US$3.5bn.

7% or 38 Gazelles from last year were demoted, ie no longer making the cut. 16 were from China, 9 from the USA and 2 from Singapore. The main sectors of dropped Gazelles were SaaS and FinTech with 7 each, followed by E-commerce with 5.

Which investors are the best at finding Gazelles?

Sequoia is the world’s most successful investment platform at finding and investing into Gazelles, investing into 96 of the world’s known Gazelles, followed by CICC, MatrixPartners, Tencent and SoftBank.

For the full Top 50 list of the Most Successful Gazelles Investors in the World 2023, see Appendix.

Comparison between Hurun Future Unicorns: Gazelles, Hurun Unicorns and Hurun Global 500

A Unicorn is a start-up founded in the 2000s, worth at least a billion dollars and not yet listed on a public exchange. The Hurun Global 500 is a list of the 500 most valuable non state-controlled businesses in the world.

The pipeline for the Hurun Global 500 is the Global Unicorn Index and the pipeline for the Global Unicorn Index is the Hurun Future Unicorns: Global Gazelle Index. From this, we can see how China and India have a higher percentage of Gazelles and Unicorns, which over the course of 5 years, ought to translate into a higher percentage of Hurun Global 500s. In the same way, France, Canada and Australia have a smaller percentage of start-ups, which suggests they will lose ground in the Hurun Global 500. The US has half of the world’s known unicorns and Global 500s, so will likely retain its dominance for the next five years.

By city, San Francisco, Shanghai, Beijing, Shenzhen and Bengaluru have more start-ups and ought to have more Hurun Global 500s within five years. Tokyo and Paris have less startups, so are likely to see their percentage of the world’s most valuable companies go down. London seems to be stable.

By industry, healthcare and business management solutions ought to grow into Hurun Global 500 companies.

Companies selling software & services and directly to businesses, rather than consumers, are on the up.

Key Statistics

Methodology

The Hurun Future Unicorns: Global Unicorn Index 2023 is compiled by the Hurun Research Institute with a 31 December 2022 cut-off. Hurun defines a Gazelle as a start-up founded in the 2000s, not yet listed on a public exchange and most likely in our opinion to reach a valuation of US$1bn – ie ‘go unicorn’ – in the next three years.

Cut-off for this year’s index was 31 December 2022, with significant valuation changes updated right up to the date of release.

For the one-year comparison, Hurun Research used the Global Gazelle Index 2021, released on 25 January 2022.

Hurun Research has been tracking unicorns since 2017 and Gazelles in China and India since 2019.

Many of the world’s top investment houses provided details of their portfolio, which the Hurun research team cross-checked against specialized investment databases, industry experts, media sources, as well as Gazelle co-founders.

Valuing Gazelles can be tricky. The very nature of these super-fast growing companies makes valuations hard to pin down, but to ensure consistency of the valuations, the Hurun research team used the most recent valuation based on a sizeable round. Where it becomes harder is when a Gazelle is underperforming or on its way down, since it is unlikely to have a new round of investment at a valuation lower than the previous round. In this case, Hurun uses industry comparatives to ascertain a new lower valuation.

Countries and cities are ranked according to the Gazelle head office.

Gazelles leave the Hurun Global Gazelles Index by being ‘promoted’ or ‘demoted’. Promotions are by becoming a unicorn, listing on a public exchange (IPO) or being acquired. Demotions are when Hurun Research believes they will no longer become a unicorn within three years.

Disclaimer. All the data collection and the research has been carried out by Hurun Research. This report is meant for information purposes only. Reasonable care and caution have been taken in preparing this report. The information contained in this report has been obtained from sources that are considered reliable. By accessing and/or using any part of the report, the user accepts this disclaimer and exclusion of liability which operates to the benefit of Hurun. Hurun does not guarantee the accuracy, adequacy or completeness of any information contained in the report and neither shall it be responsible for any errors or omissions in or for the results obtained from the use of such information. No third party whose information is referenced in this report under the credit to it, assumes any liability towards the user with respect to its information. Hurun shall not be liable for any decisions made by the user based on this report (including those of investment or divestiture) and the user takes full responsibility for their decisions made based on this report. Hurun shall not be liable to any user of this report (and expressly disclaim liability) for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential losses, loss of profit, lost business and economic loss regardless of the cause or form of action and regardless of whether or not any such loss could have been foreseen.

Hurun Future Unicorns in the World 2023

About Hainan Free Trade Port Resort Software Community

Hainan Free Trade Port Resort Software Community (Hereinafter RSC) is the key platform that reaped the advanced policy of Hainan Free Trade Port (Hereinafter FTP) in the early stage of the development of the digital economy in Hainan FTP. RSC is positioned to be the source of digital trade, digital financial innovation and a gathering place for medium and high-end talents. RSC focuses on “1 Zone plus 3 Industries”, that is, to create a national-level blockchain pilot zone, and use blockchain and other technologies to empower industries such as digital culture and sport, digital health and digital finance. In 2022, RSC generated RMB 239.134 billion in business revenue and RMB 15.295 billion in tax revenue. With an average annual increase of 92% in tax revenue over the past three years, and over 13,500 enterprises registered in RSC so far.

RSC is already a benchmark model for the integrated development of industry and city in Hainan FTP, advocating "a happy city, a happy success". The RSC offers a beautiful garden-style office environment, "working in the park, innovating in life", and a "micro-city" of work, residence, education, business and leisure for industrial talents. The iSchool, theatre, library, gymnasium and medical facilities are all in place to cater to the needs of the three generations of talents, including their careers, children's education and parents' retirement, thus truly fulfilling their aspirations for a better life!

About Hurun Inc.

Promoting Entrepreneurship Through Lists and Research

Oxford, Shanghai, Mumbai, Sydney, Paris

Established in the UK in 1999, Hurun is a research, media and investments group, promoting entrepreneurship through its lists and research. Widely regarded as an opinion-leader in the world of business, Hurun generated 6 billion views on the Hurun brand last year, mainly in China and India.

Best-known today for the Hurun Rich List series, telling the stories of the world’s successful entrepreneurs in China, India and the world, Hurun’s two other key series include the Hurun Start-up series and the Hurun 500 series, a ranking of the world’s most valuable companies.

The Hurun Start-up series begins with the Hurun U30s, an awards recognizing the most successful entrepreneurs under the age of thirty, and is today in seven countries. Next up are Hurun Cheetahs, Chinese and Indian start-ups with a valuation of between US$300mn to US$500mn, most likely to go unicorn with five years. Hurun Global Gazelles recognize start-ups with a valuation of US$500mn to US$1bn, most likely to go unicorn within three years. The culmination of the start-up series is the Hurun Global Unicorn Index.

Other lists include the Hurun Philanthropy List, ranking the biggest philanthropists, the Hurun Art List, ranking the world’s most successful artists alive today, etc…

Hurun provides research reports co-branded with some of the world’s leading financial institutions, real estate developers and regional governments.

Hurun hosted high-profile events in the last couple of years across China and India, as well as London, Paris, New York, LA, Sydney, Luxembourg, Istanbul, Dubai and Singapore.

For further information, see www.hurun.net.

For media inquiries, please contact:

Hurun Report

Porsha Pan

Tel: +86-21-50105808*601

Mobile: +86-139 1838 7446

Email: porsha.pan@hurun.net

Grace Liu

Tel: +86-21-50105808

Mobile: +86 136 7195 4611

Email: grace.liu@hurun.net

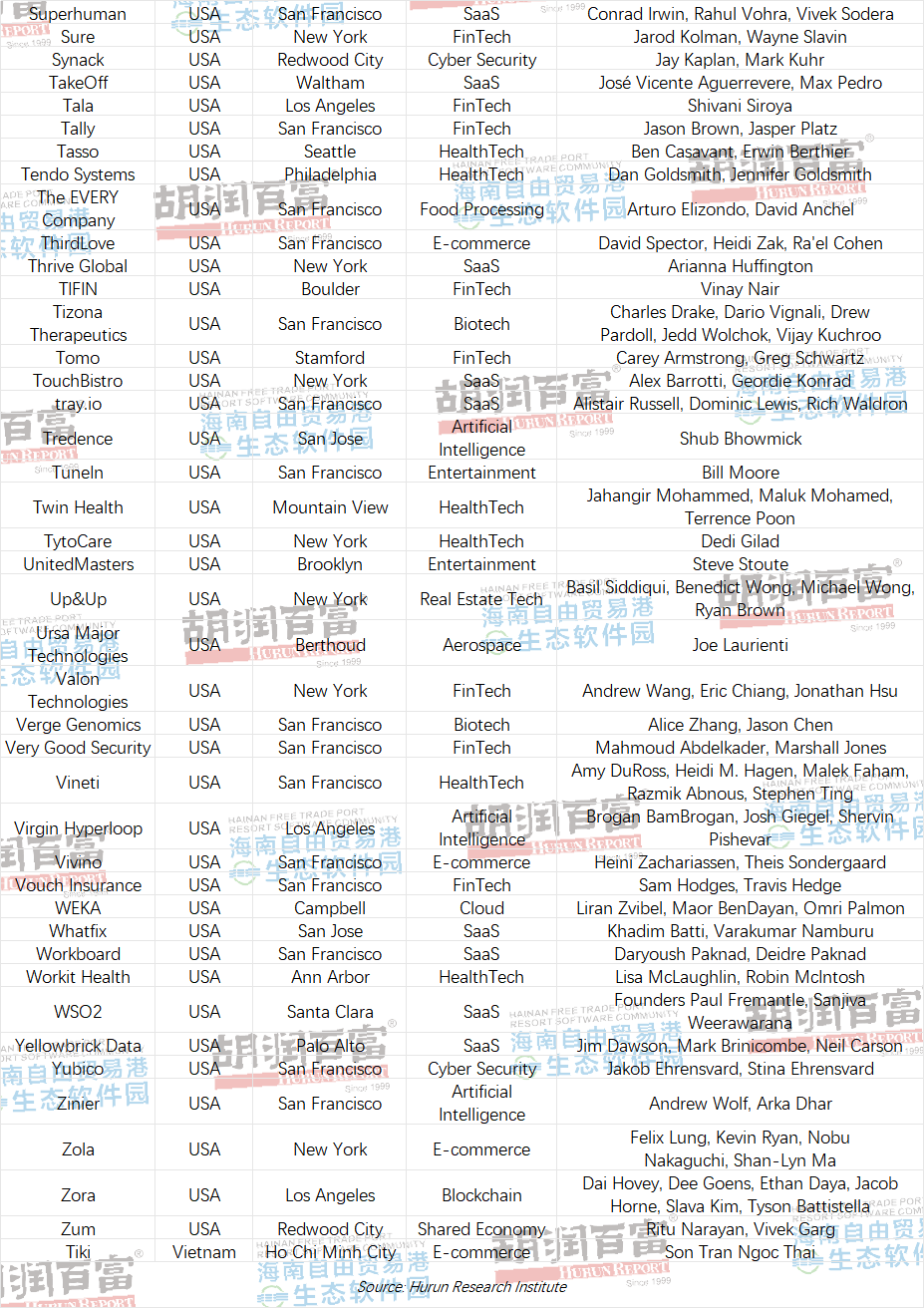

Appendix – Most Successful Gazelles Investors in the World 2023