A Year of Outstanding Innovation | The 2023 Burgundy Private Hurun India 500

The 2023 Burgundy Private Hurun India 500 is 2023’s definitive list of the top 500 private companies in India, ranked by market valuation.

The 2023 Burgundy Private Hurun India 500 is 2023’s definitive list of the top 500 private companies in India, ranked by market valuation.

Axis Bank and Hurun India are proud to publish the third edition of the Burgundy Private Hurun India 500. The report is a compendium of India’s 500 most aspirational and successful companies. It showcases corporate India’s vision, impact and resilience to overcome internal and global challenges.

You will find that companies with a minimum value of INR 6,700 crore, which feature in this years list, truly epitomise economic strength blended with diversity. Collectively, these industrial powerhouses provide livelihood to 1.3% of the organised workforce. That 52 companies are less than 10 years old, stands testimony to the entrepreneurial spirit that drives our emerging business oeuvre.

The CEO and Chief Researcher of Hurun India, Anas Rahman Junaid, described it as “a comprehensive narrative that reflects the dynamic nature of India's economic landscape”.

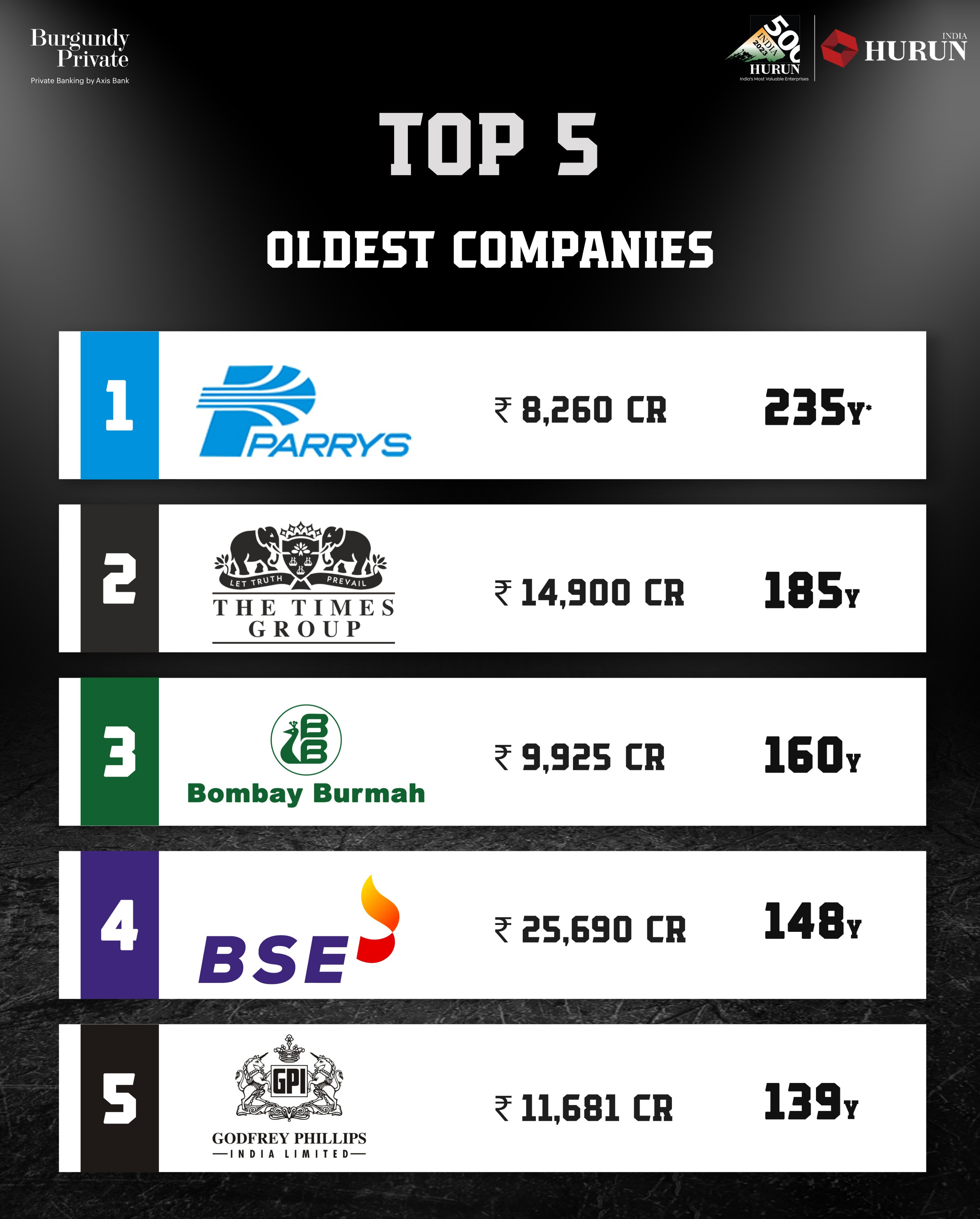

He said :“At the heart of this list is the remarkable diversity, spanning from the venerable 235-year-old EID-Parry to startups founded as recently as 2021. This blend of historical legacy with innovative entrepreneurship symbolizes the dynamic and evolving nature of India's economic landscape, showcasing its strength and adaptability on the global stage.”

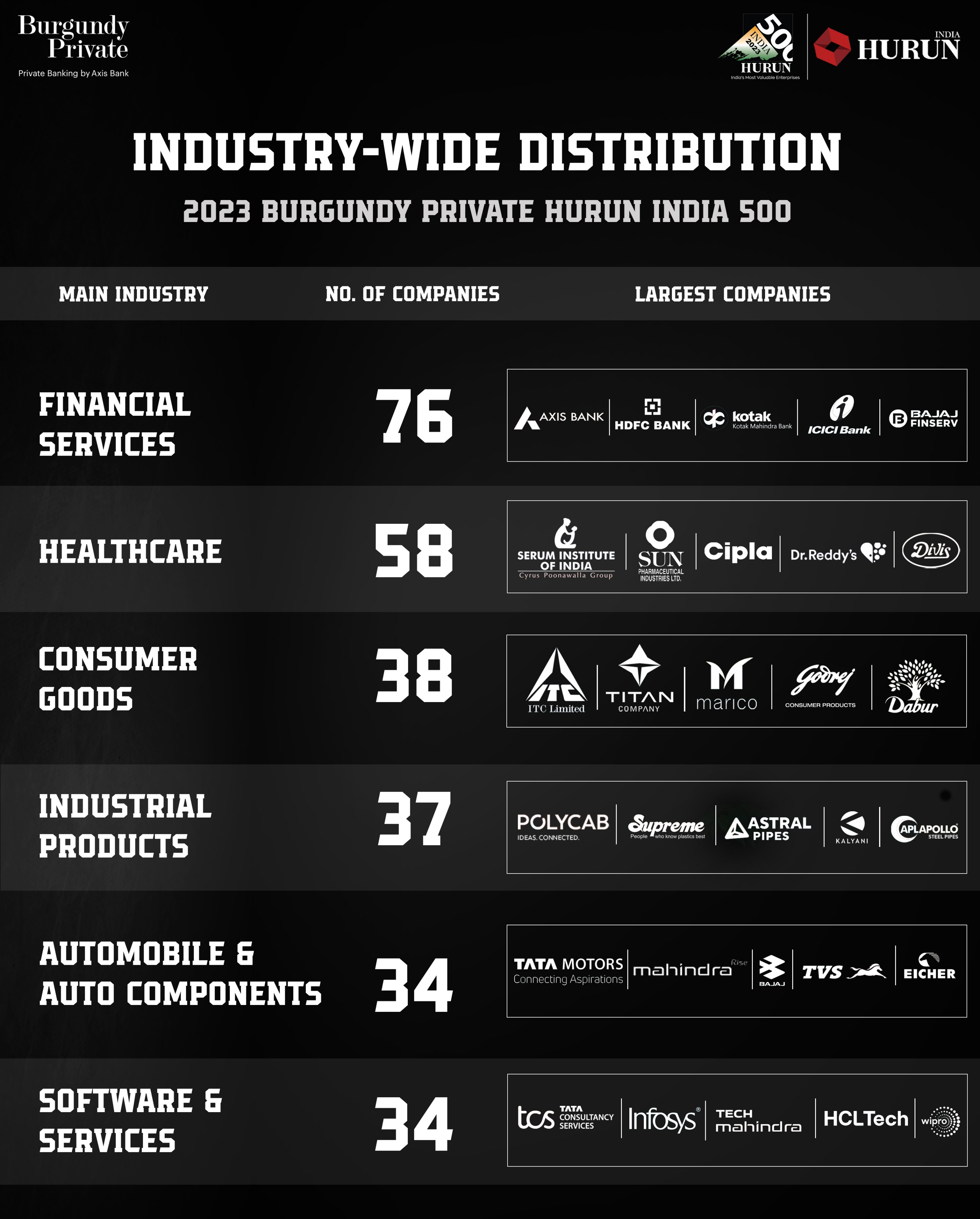

“Geographically, the 2023 Burgundy Private Hurun India 500 highlights the inclusive nature of India's economic development. It brings into focus not only major economic centers like Mumbai and Bengaluru but also showcases the importance of cities like Thrissur, Kochi, and Surat, each contributing uniquely to the nation's economic narrative. Industrially, the list reflects the multifaceted nature of India's economy. It spans a wide array of sectors, from finance and healthcare to consumer goods, IT, and automotive, with leading companies like HDFC Bank, Sun Pharma, ITC, and Tata Motors exemplifying the breadth and depth of India's industrial prowess.”

“A noteworthy aspect of this year's list is the volatility and unpredictability of the business world, exemplified by the significant value drop of a major player like Paytm post-review period due to regulatory changes. This serves as a stark reminder of the dynamic and sometimes unpredictable nature of the economic environment, highlighting the challenges businesses may face.”

The 500 companies together have a collective worth of INR 231 lakh crore or USD $2.8tn, spread around 44 cities across India. 12% of the list are new entrants, with the statistic increasing every year. Burgundy Private, Axis’ private banking branch, now is directly affiliated with 35 of the top 100 businesspeople on the Forbes 100 wealthiest Indians.

Reliance Industries is India’s most valuable company, worth INR15.6 lakh crore, followed by Tata Consultancy Services and then HDFC Bank in third place. 95% of the companies on the list have female representation on their respective executive boards, reflecting the ever-increasing representation of women in business.These 500 companies alone contribute to 37% of the country’s GDP. The financial services sector is where the majority of companies on this list come from, closely followed by the Healthcare sector, and then the Consumer Goods sector.

In total, these companies employ over 10 million people, and their combined revenues amount to INR 79 trillion (US $945bn), and their market value accounts for over 90% of India’s total stock capitalisation. On top of this, these companies significantly contribute to the national exchequer through corporate taxation, GST and other levies. This highly supports the government’s fiscal stability and ensures it can fund public services for the Indian population- as of the 1st of January 2024, this is estimated to be at 1.4 billion people. Thus, this stability is more vital than ever for the advancement of the country.

Many of these companies are at the forefront of capital investment, driving infrastructure development, technological progression, and R&D. These investments not only spur own their own company’s development but also broader economic growth. In turn, many of these companies have a strong global presence, contributing to India’s export earnings and overall enhancing its national reputation in international markets.

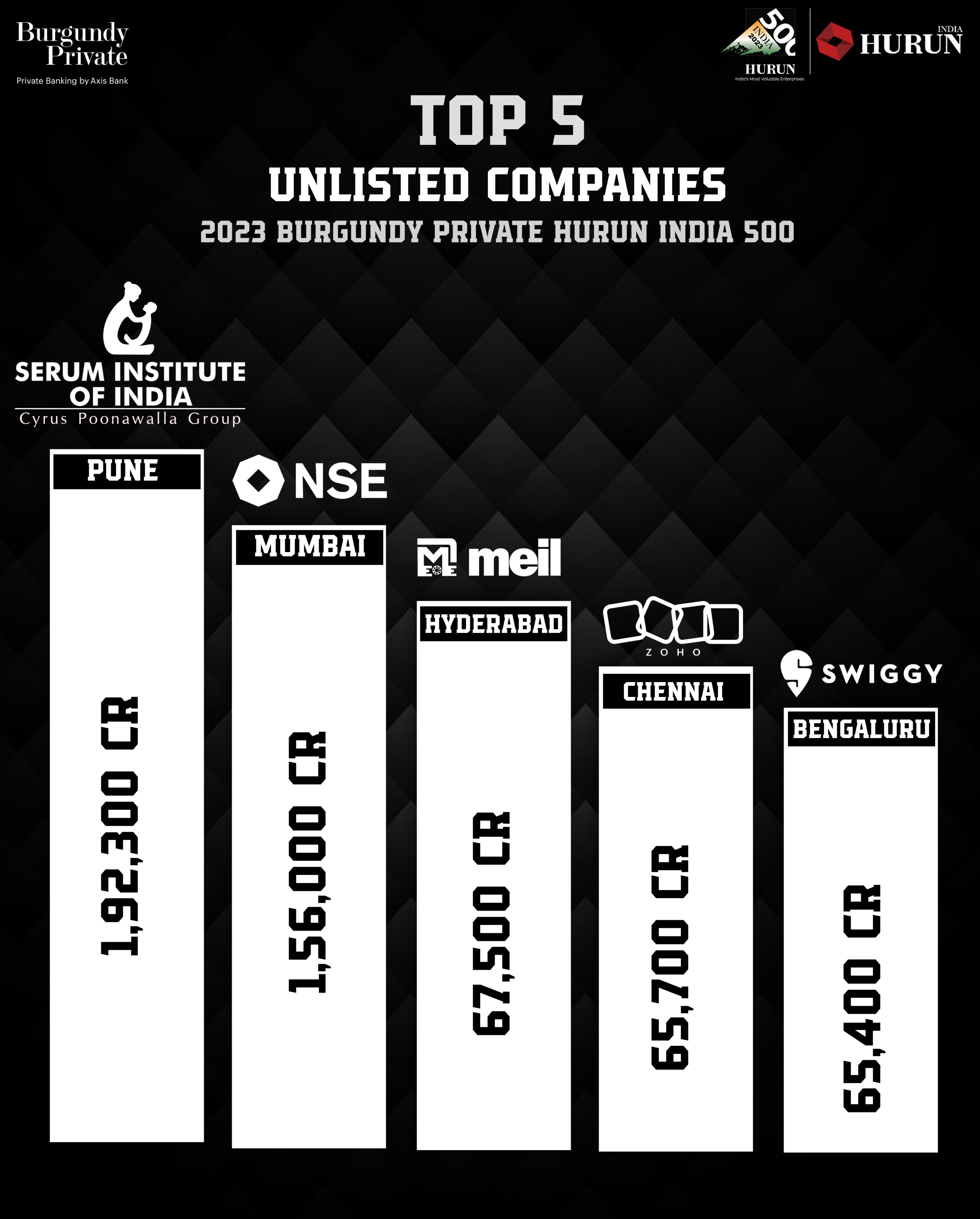

The 2023 Burgundy Private Hurun India 500 also shines the spotlight on the rapidly growing influence of private unicorn companies- companies valued at over US $1bn and founded after 2000. Over 70 unicorns are on the list, collectively valued at over INR 12 trillion (US $150bn). These companies are more technologically oriented, representing India’s growing influence on the global stage in the digital age. Fintech, E-Commerce and Edtech are the biggest unicorn sectors. Multiple of these unicorns, such as Byju’s, Swiggy and Paytm, have rapidly become household names in India, re-writing the status quo and breaking into new markets. This growth is indicative of the digital transformation sweeping across the country, and Asia as a whole.