Hurun Global Rich List 2025

Hurun Research today released the Hurun Global Rich List 2025, a ranking of the US dollar billionaires in the world. Wealth calculations are a snapshot of 15 January 2025. This is the 14th year of the ranking.

HURUN GLOBAL RICH LIST 2025

3,442 BILLIONAIRES IN WORLD, UP 163, NEW WORLD RECORD

FOR THE FIRST TIME IN TEN YEARS, NUMBER OF U.S. BILLIONAIRES OVERTAKES CHINA, 870, UP 70, COMPARED WITH 823, UP 9.

INDIA THIRD WITH 284 BILLIONAIRES, UP 13, FOLLOWED BY THE UK, GERMANY AND SWITZERLAND. SINGAPORE, RUSSIA, CANADA, TURKEY AND MEXICO BILLIONAIRES ARE ON THE UP.

ELON MUSK, 53, RICHEST PERSON IN THE WORLD FOR THE FOURTH TIME IN FIVE YEARS, WITH US$420BN, UP 82% OR US$189BN, DRIVEN BY SURGE IN TESLA SHARE PRICE POST TRUMP ELECTION.

JEFF BEZOS, 61, OF AMAZON SECOND WITH US$266BN, UP 44% OR US$81BN.

MARK ZUCKERBERG, 40, BREAKS INTO TOP THREE IN THE WORLD FOR THE FIRST TIME, WITH US$242BN, UP 53% OR US$84BN, AS META’S INVESTMENT INTO AI PAYS OFF.

JENSEN HUANG, 62, OF NVIDIA SAW WEALTH ALMOST TRIPLE TO US$128BN AND 11TH PLACE.

BY CITY, NEW YORK IS THE BILLIONAIRE CAPITAL OF THE WORLD FOR THE SECOND YEAR RUNNING WITH 129, UP 10, FOLLOWED BY LONDON WITH 97.

SHANGHAI OVERTOOK MUMBAI TO CLAIM TITLE OF ASIA’S BILLIONAIRE CAPITAL FOR THE FIRST TIME, WITH 92 BILLIONAIRES. MUMBAI 90, DOWN 2.

AI, MONEY MANAGERS, ENTERTAINMENT, CRYPTO AND ELON MUSK HAD A GOOD YEAR, WHILST LUXURY, TELECOMMUNICATIONS, AGRICULTURE AND CHINA REAL ESTATE HAD A BAD YEAR.

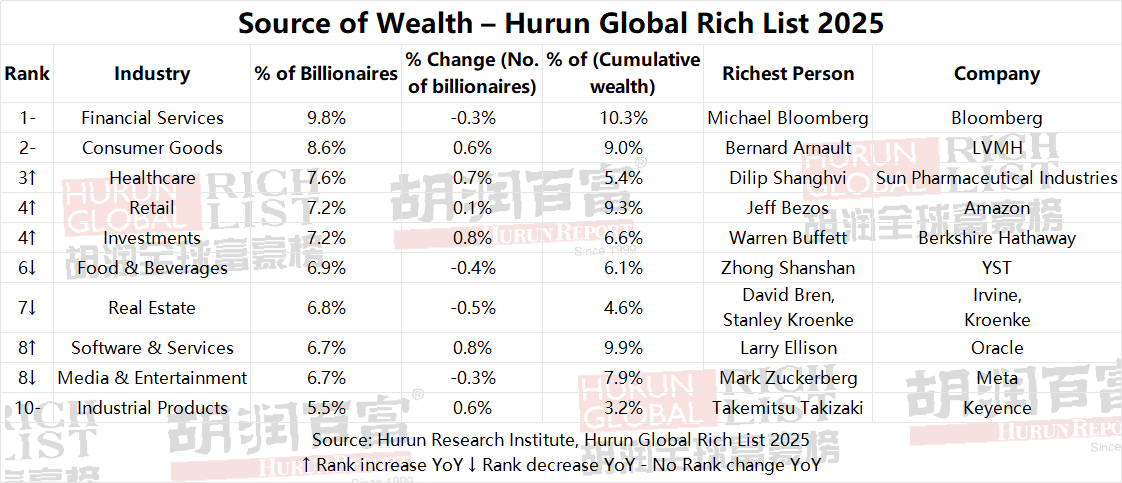

FINANCIAL SERVICES IS THE MAIN SOURCE OF WEALTH FOR BILLIONAIRES, WITH ONE IN TEN MAKING THEIR MONEY THERE, FOLLOWED BY CONSUMER GOODS AND HEALTHCARE.

AI. SAM ALTMAN, 39, OF OPENAI MADE THE HURUN GLOBAL RICH LIST FOR THE FIRST TIME WITH US$1.8BN.

DONALD TRUMP, RICHEST US PRESIDENT IN HISTORY, BROKE INTO THE HURUN TOP 500, WITH WEALTH ALMOST TRIPLING TO US$7.2BN, ON THE BACK OF HIS 53% SHARE IN TRUTH SOCIAL.

BIGGEST GROWTH IN CHINA. BEIJING-BASED LEI JUN, 56, OF MOBILE PHONE TO ELECTRIC CAR BRAND XIAOMI WAS ONE OF THE FASTEST RISERS OF THE YEAR, MORE THAN DOUBLING HIS WEALTH TO US$30BN AND A TOP 50 PLACE. OTHERS OF NOTE INCLUDED ROBIN ZENG YUQUN OF BATTERY MAKER CATL, WHOSE WEALTH BOUNCED BACK 61% TO US$37BN, BEIJING-BASED CHEN TIANSHI, 40, OF CHIP MAKER CAMBRICON, UP MORE THAN FIVE-FOLD TO US$9.8BN, ZHOU CHAONAN, 65, OF BYTEDANCE DATA CENTER OPERATOR RANGE INTELLIGENT, MORE THAN DOUBLING TO US$5.8BN, AND BEIJING-BASED GRANT WANG NING, 38, OF TOYMAKER POPMART, QUADRUPLING TO US$6.9BN.

BIGGEST DROPS IN WEALTH. FRANCOISE BETTENCOURT MEYERS OF L'OREAL SAW THE BIGGEST DROP, LOSING US$24BN. IN PERCENTAGE TERMS, TAKAHISA TAKAHARA OF JAPAN HYGIENE PRODUCTS MAKER, UNICHARM, WAS THE BIGGEST LOSER WITH A DECLINE OF 73%.

TIKTOK FOUNDER ZHANG YIMING, 42, OF BYTEDANCE OVERTOOK ‘BOTTLED WATER KING’ ZHONG SHANSHAN, 71, FOR NUMBER ONE IN CHINA. PONY MA, 54, OF TENCENT OVERTOOK COLIN HUANG OF PINDUODUO FOR A TOP THREE PLACE.

MUKESH AMBANI OF RELIANCE RECLAIMED THE TITLE OF ‘RICHEST PERSON IN ASIA’ WITH US$100BN, DOWN US$15BN. GAUTAM ADANI WAS 18TH WITH US$97BN, UP 13%. ADANI BRIEFLY HELD THE TITLE IN THE PAST YEAR.

ROSHNI NADAR & FAMILY OF HCL, WITH US$40BN BECOMES THE FIRST WOMAN TO MAKE INDIA’S TOP 10, AFTER HER FATHER SHIV NADAR TRANSFERRED A 47% STAKE IN HCL TO HER.

177 INDIVIDUALS LOST THEIR BILLIONAIRE STATUS, NEARLY HALF FROM CHINA.

387 JOINED THE LIST, WITH 96 FROM USA AND 91 FROM CHINA, FOLLOWED BY INDIA WITH 45.

BRAZIL-BASED LIVIA VOIGT, 20, OF ELECTRICAL MOTORS MAKER WEG, BECAME WORLD’S YOUNGEST BILLIONAIRE WITH US$1.3BN.

LEADING AUTHORITY ON GLOBAL WEALTH, HURUN REPORT, RELEASES THE 14TH HURUN GLOBAL RICH LIST.

Key Findings

1. 3,442 BILLIONAIRES IN THE WORLD, UP 5% OR 163 FROM LAST YEAR.

2. SOURCES OF WEALTH. BILLIONAIRES MADE THEIR WEALTH IN FINANCIAL SERVICES (9.8%), CONSUMER GOODS (8.6%), HEALTHCARE (7.6%) AND RETAIL & INVESTMENTS WITH (7.2%) EACH.

3. FASTEST RISERS OF THE YEAR. 82 INDIVIDUALS ADDED US$5BN OR MORE, UP FROM 59 LAST YEAR.

4. AVERAGE AGE OF THE LIST: 66 YEARS, BORN 1959.

5. 129 FORTY OR UNDER, OF WHICH 75, UP 14, WERE SELF-MADE AND 54 INHERITED. 15 ARE UNDER 30, WITH YOUNGEST BOTH AGED 20, MILAN-BASED CLEMENTE DEL VECCHIO OF EYEWEAR GIANT ESSILORLUXOTTICA WITH US$6BN AND BRASIL-BASED LIVIA VOIGT OF ELECTRICAL MOTOR MAKER WEG, WITH US$1.3BN.

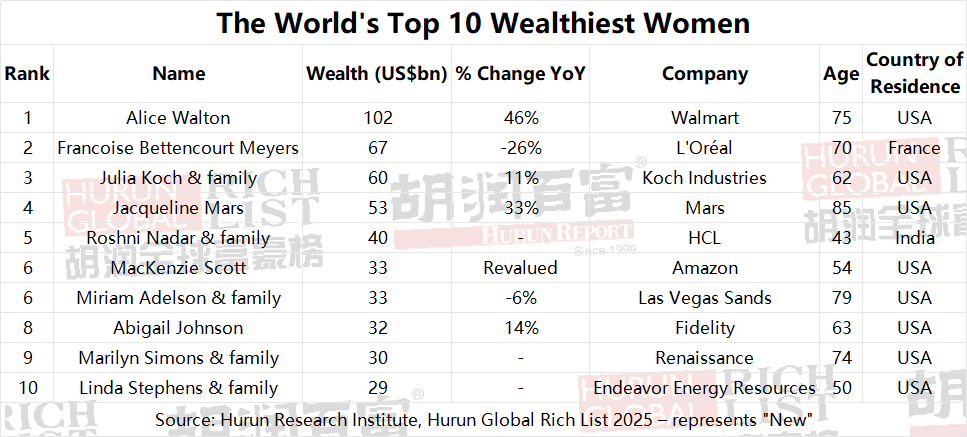

6. 224 SELF-MADE WOMEN, UP 6. CHINA CONTINUED TO DOMINATE WITH 72%. OKLAHOMA-BASED ‘ROOFING QUEEN’ DIANE HENDRICKS, 77, OF ABC SUPPLY RICHEST SELF-MADE WOMAN IN THE WORLD FOR THE THIRD YEAR WITH US$23BN, WHILST ALICE WALTON, 75, OF WALMART RICHEST WOMAN IN THE WORLD WITH US$102BN.

7. 15% IMMIGRANT BILLIONAIRES, A NOMINAL DECREASE FROM 15.4% LAST YEAR. USA LED WITH 206 IMMIGRANT BILLIONAIRES, FOLLOWED BY 76 IN THE UK AND 73 IN SWITZERLAND. NOTABLE IMMIGRANTS INCLUDED ELON MUSK (BORN IN SOUTH AFRICA), SERGEY BRIN (BORN IN RUSSIA) AND JENSEN HUANG (BORN IN TAIWAN).

8. OLDEST FAMILIES. 115 ARE BILLIONAIRES FOR 4TH GENERATION OR MORE, DOWN 3 FROM LAST YEAR.

27 March 2025, Shanghai, China and Mumbai, India: Hurun Research today released the Hurun Global Rich List 2025, a ranking of the US dollar billionaires in the world. Wealth calculations are a snapshot of 15 January 2025. This is the 14th year of the ranking.

Stock Markets and Currencies. In the year to 15 January 2025, stock markets generally performed well, with notable gains across major indices. In the US, Nasdaq rose 28% and the S&P 500 gained 22%. In Europe, Germany’s DAX jumped 21%, the EURO STOXX 50 climbed 11% and the Paris-based Euronext 100 was up 6%. In China, Hong Kong’s Hang Seng Index was up 19%, and SZSE and SSE both rose 12%, marking a recovery from last year. The UK FTSE 100 recorded an 8% increase, reversing last year's decline. India's Sensex was up 7%. Russia's MOEX was down 7%.

The US dollar strengthened slightly against most major currencies over the year to 15 January 2025. It rose 5% against the euro, 4% against the Indian rupee and 2% against the British pound. The dollar held steady against the Chinese yuan. The largest gain was against the Turkish lira, surging 47%, followed by a 12% increase against the Russian ruble and an 11% rise against the South Korean won. Bitcoin surged 142%, and crude oil rose by 6%.

The List at a glance

The Hurun Global Rich List 2025 ranked 3,442 billionaires, up from 3,279 last year, from 2,524 companies and 71 countries. The number of billionaires increased by 5%, and their total wealth increased by 13%.

1,958 saw their wealth increase, of which 387 were new faces. 1,260 saw their wealth decrease, of which 177 dropped off. A further 399 stayed the same. 67% were self-made, and 33% inherited their wealth. 59% make their money by selling to consumers, ie B2C, whilst 41% sell to businesses, ie B2B. 62% sell physical products, whilst 38% sell software and services. The average age was 66.

Hurun Report, the Chairman and Chief Researcher, Rupert Hoogewerf, remarked,

“The Hurun Global Rich List tells the story of the global economy through the stories of the world’s most successful entrepreneurs. Who’s up and who’s down, which countries and sectors are on the up and which are on the way down, these combine to give an insight into the trends driving the global economy.”

“60% of this year’s billionaires were not on the list ten years ago, showing how wealth creation has dramatically changed with the advent of new technologies.”

“The concentration of economic power continues. Billionaires are at world record numbers, with 3,442 billionaires, up 5%, largely on the back of a surge in US stock markets and the continued strength of the dollar. The number of members of the ‘Ten zero club’, ie those with US$10bn or more, is now within touching distance of 300, whilst the number of members of the ‘Eleven zero club’, ie those with more than US$100bn, has grown from zero in 2017 to whopping 17 today. As AI goes mainstream, the concentration of wealth is going to get worse. At this rate, expect to see within five years, ie by 2030, the world's first trillionaire, 100 individuals with US$100bn, 500 with US$10bn and well over 4000 with US$1bn.”

“Its been a good year for AI, money managers, entertainment and crypto. Its been a tough year for luxury, telecommunications and real estate in China. For AI, shareholders of Nvidia, Alphabet, Oracle, Broadcom and Microsoft, as well as Sam Altman of OpenAI had a good year. For money managers, Steve Schwarzman of Blackstone, Ken Griffin of Citadel, Leon Black of Apollo and Henry Kravis and George Roberts of KKR had a good year. For entertainment, Mark Zuckerberg of Meta, Zhang Yiming of ByteDance and Pony Ma of Tencent had a good year. Retail has been a mixed bag, with the Walton family of Walmart and Jeff Bezos of Amazon growing strongly, while the likes of Huang Zheng of Pinduoduo, and the Albrecht brothers of Aldi Sued and Aldi Nord having difficult years.”

“Donald Trump’s election win gave US-based billionaires a significant post-election bonus. Close allies Elon Musk and tech investor Peter Thiel saw their wealth surge 82% to US$420bn and 67% to US$14bn. The US President’s following has contributed to Trump’s wealth almost tripling to US$7.2bn. Since our cut-off of 15 January 2025, Musk has lost US$100bn after Tesla saw its market cap plunge by US$700bn, as investors took fright from increased competition from Chinese EV makers and a consumer backlash over Musk’s politics. Despite the drop, Musk is still the richest person in the world.”

“The rise of AI continues. Jensen Huang saw his wealth break through the US$100bn mark, despite only owning 3% of Nvidia stock, driven by Nvidia’s dominance in AI-capable GPUs, the infrastructure of advancing AI technologies. One major new entrant in the AI billionaire club is Sam Altman, 39, of OpenAI, with US$1.8bn, after OpenAI restructured its shareholdings away from its original not for profit model.”

“Bitcoin’s breaking through the highly symbolic US$100,000 mark has significantly benefited top crypto founders. Binance’s CZ Zhao has seen his wealth rise to US$22bn, still comfortably the Richest Crypto Billionaire, while Coinbase’s Brian Armstrong has US$11bn, up 72%. Bitcoin holders have also gained substantially, with MicroStrategy’s Michael Saylor all but tripling to US$8.9bn and the Winklevoss brothers of Gemini each almost doubling to US$3.8bn. On average, crypto billionaires have witnessed an 80% year-on-year growth in wealth.”

“Whilst China and the US each had over 90 new faces in the Hurun Global Rich List, China saw more than 80 faces from last year drop off, compared with just under 20 for the US. The reason? China’s economy is continuing to restructure, with the drop-offs coming from a weeding out of Healthcare and New Energy and traditional Manufacturing, as well as Real Estate.”

“Big philanthropy is not keeping up with wealth creation. We only managed to find three individuals in the past year who donated more than US$1bn, despite the billionaires adding US$1.6tn between them in the past year. Warren Buffett was the most generous, donating US$5.3bn, mainly to the Bill & Melinda Gates Foundation. The other two were Michael Bloomberg, who donated US$3.7bn, and Reed Hastings of Netflix, who donated US$1.1bn.”

“Russia billionaires have increased in number, up 13 to 89, but collectively their wealth is down as the war with Ukraine continued and prices of commodities and energy came down. A further 38 Russian-born billionaires live outside of their home country, primarily in Switzerland, the UK and Israel.”

“France recorded the steepest wealth decline, losing US$54bn, as Francoise Bettencourt Meyers of L’Oréal, Bernard Arnault of LVMH and Francois Pinault of Kering between them were down US$50bn. The downturn in the luxury sector was closely linked to the slowdown in the Chinese market, the end of a pandemic-driven surge in ‘revenge spending’ and political uncertainty in France.”

“Despite the war in Gaza, billionaires in the Middle East have had a good year, led by the UAE, Israel and Saudi Arabia, reflecting the region's evolving economic landscape."

“Four singers, six sportsmen and one influencer made this year’s Hurun billionaires list. Singers were Jay-Z, Rihanna, Taylor Swift and Paul McCartney. Sportsmen were Michael Jordan, Tiger Woods, Floyd Mayweather, LeBron James, Christiano Ronaldo and Lionel Messi. The influencer was Kim Kardashian.”

“How many billionaires are missing from our list? Whilst Hurun Research goes to great lengths to dig out all the billionaires in the world, we only use publicly available information, and some people go to extraordinary lengths to keep their wealth out of the public eye. We have nonetheless managed to find just over 3400 billionaires, and estimate that we have missed perhaps 2000, with the bulk from Saudi Arabia and the other Gulf States, meaning the world probably today has over 5000 billionaires.”

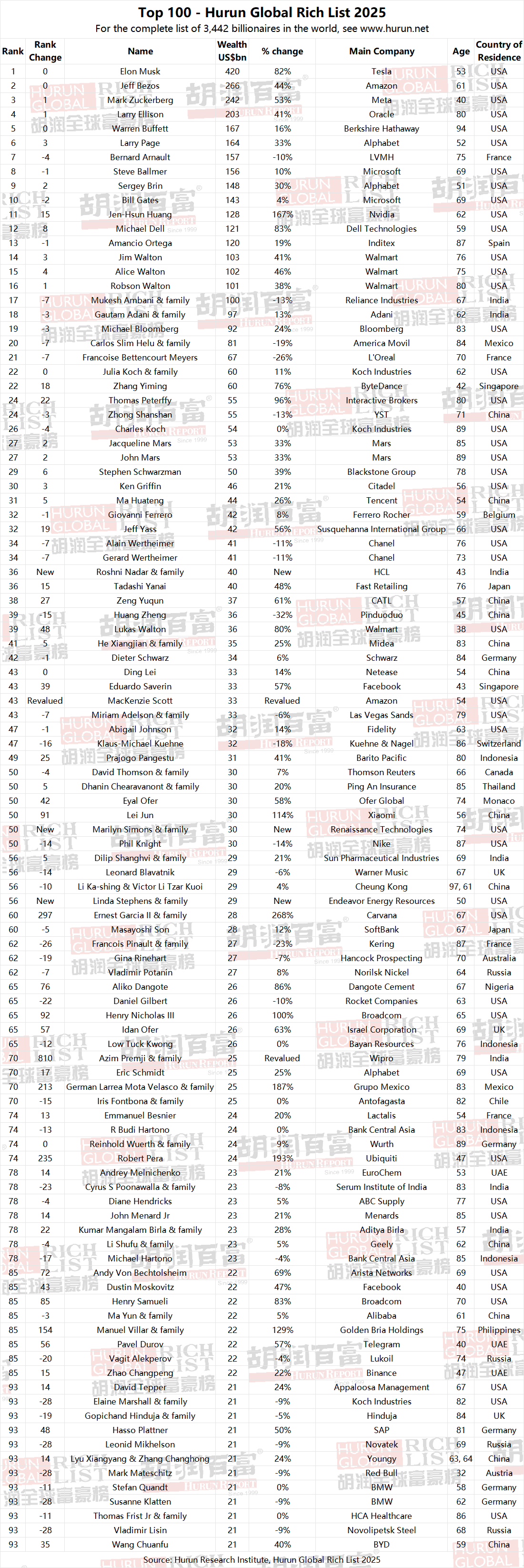

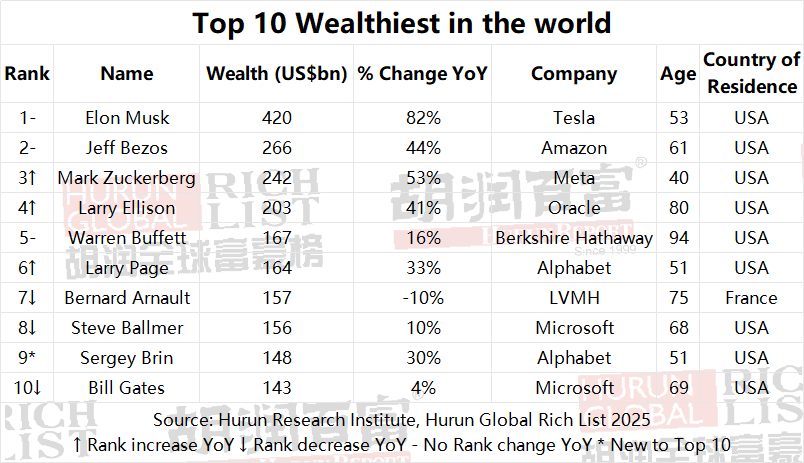

Top Ten - Hurun Global Rich List 2025

Sergey Brin was back in the Hurun Top 10, at the expense of Mukesh Ambani. Only Bernard Arnault of France prevented a clean sweep for the US.

The Top 10 added US$512bn, 30% of total new wealth, and are worth US$2.1tn or 12% of the total list.

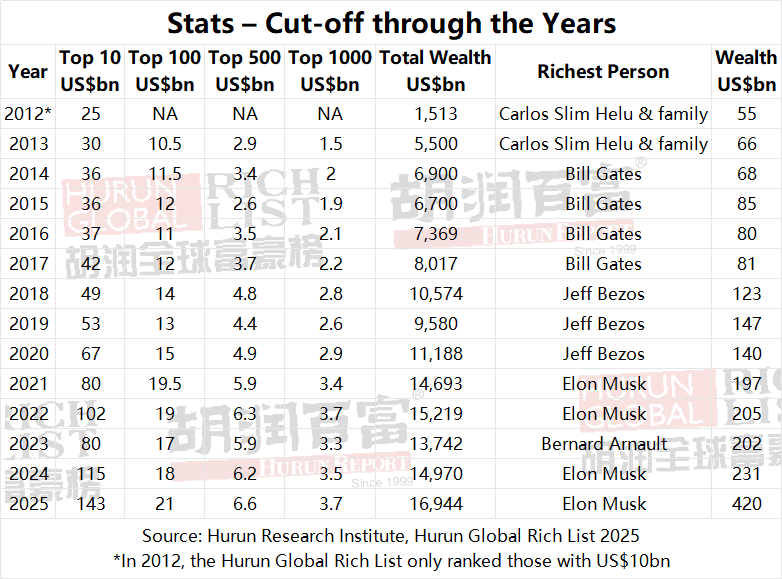

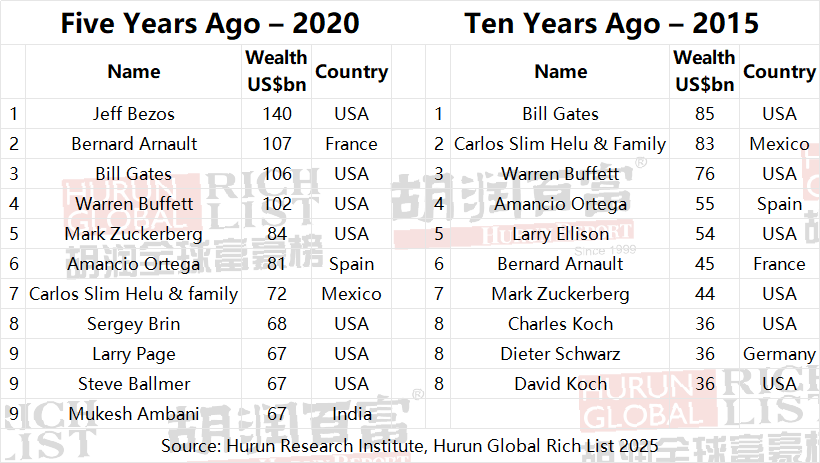

The cut-off to make the Hurun Global Rich List Top 10 has almost doubled every five years, from US$36bn ten years ago to US$67bn five years ago and US$143bn this year.

Table 1: Top 10 Wealthiest in the world

At 53, Elon Musk reclaimed the title of the wealthiest person in the universe for the fourth time in five years, and becoming the first individual to surpass the US$400bn mark. In an extraordinary financial leap, Elon Musk's net worth surged by US$189bn or 82%, primarily attributed to the ‘Trump effect’ on Tesla's stock price. Since our cut-off of 15 January 2025, Musk’s wealth has dropped by around US$100bn, as his involvement with Doge, political activism and competition from Chinese companies have collectively taken a toll on Tesla’s share price. However, he remains comfortably the wealthiest person in the world.

Jeff Bezos, 61, held off a recent surge from Mark Zuckerberg to retain second spot with US$266bn, up 44%, driven primarily by a surge in Amazon's stock price, fuelled by investor optimism over the impact of its cost cutting as well as its AI and cloud services.

Mark Zuckerberg, 40, with US$242bn, up US$84bn, broke into the Top 3 for the first time, driven by investor optimism regarding Meta's AI and tech infrastructure. Zuckerberg made the headlines in the past year with his extreme fitness regimes.

Larry Ellison, 80, rose one spot with US$203bn, up US$59bn, as Oracle expanded its AI-empowered cloud services and strategic partnerships.

Warren Buffett, 94, kept a Top 5 place with US$167bn, up US$23bn, showing no signs of slowing down as he continues to live modestly despite his immense wealth. Committing to donate over 99% of his wealth, he has already contributed more than US$60bn, primarily through the Gates Foundation and foundations established by his children.

Larry Page, 51, rose three spots in the rankings and was up 33% with US$164bn, primarily driven by a 33% surge in Alphabet's stock price. Page is known for his passion for kiteboarding.

'Luxury King' Bernard Arnault, 75, lost US$18bn, dropping him to seventh place with US$157bn, as LVMH share price continued to be battered by China’s slow economy, France’s political uncertainties and a push back against luxury.

Steve Ballmer, 68, was up 10% to US$156bn and 8th place, with the bulk of his wealth still in Microsoft shares.

At 51, Sergey Brin, climbed two spots into the Top 10, with his wealth rising by 30% to US$148bn, largely driven by a significant surge in Alphabet's stock price. Brin is recognized for his philanthropic activities, donating US$200mn last year to climate-related causes.

Bill Gates, 69, held on to a Top 10 place, with his wealth up only by 4% to US$143bn. Bill Gates' primary focus has shifted to investments, having reduced his ownership in Microsoft to just 1%, down from his 45% stake at the time of IPO.

The World's Top 10 Women

561 women made the Hurun Global Rich List, of which 224 are self-made. The World's Top 10 wealthiest women are worth a US$479bn, accounting for 20% of the overall wealth of women.

Table 2: The World's Top 10 Wealthiest Women

Alice Walton is the richest woman on the planet, with US$102bn, up 46%, primarily derived from a surge in Walmart’s share price.

Next is Francoise Bettencourt Meyers of L'Oréal, with US$67bn, down 26%, as L'Oréal has struggled with competition and a slowing US market.

Julia Koch & family of Koch Industries is worth US$60bn, up 11% from last year, driven by the company's strong financial position. Koch Industries' diversified operations, resilient cash flows, and strategic investments have contributed to this wealth increase.

Jacqueline Mars was fourth with US$53bn, up 33%, from pet food and chocolate giant, Mars, driven by the strong growth of the pet food industry.

Roshni Nadar & family broke into the Hurun Top 10 Women with US$40bn, after her father Shiv Nadar transferred a 47% stake in India-based HCL.

Abigail Johnson was eighth with US$32bn, up 14%, as Fidelity took on an extra US$400bn of assets under management.

Marilyn Simons, 74, & family and Linda Stephens, 50, & family both made it straight into the Top 10 on the death of their husbands James Simons of Renaissance Technologies and Autry Stephens of Endeavor Energy Resources.

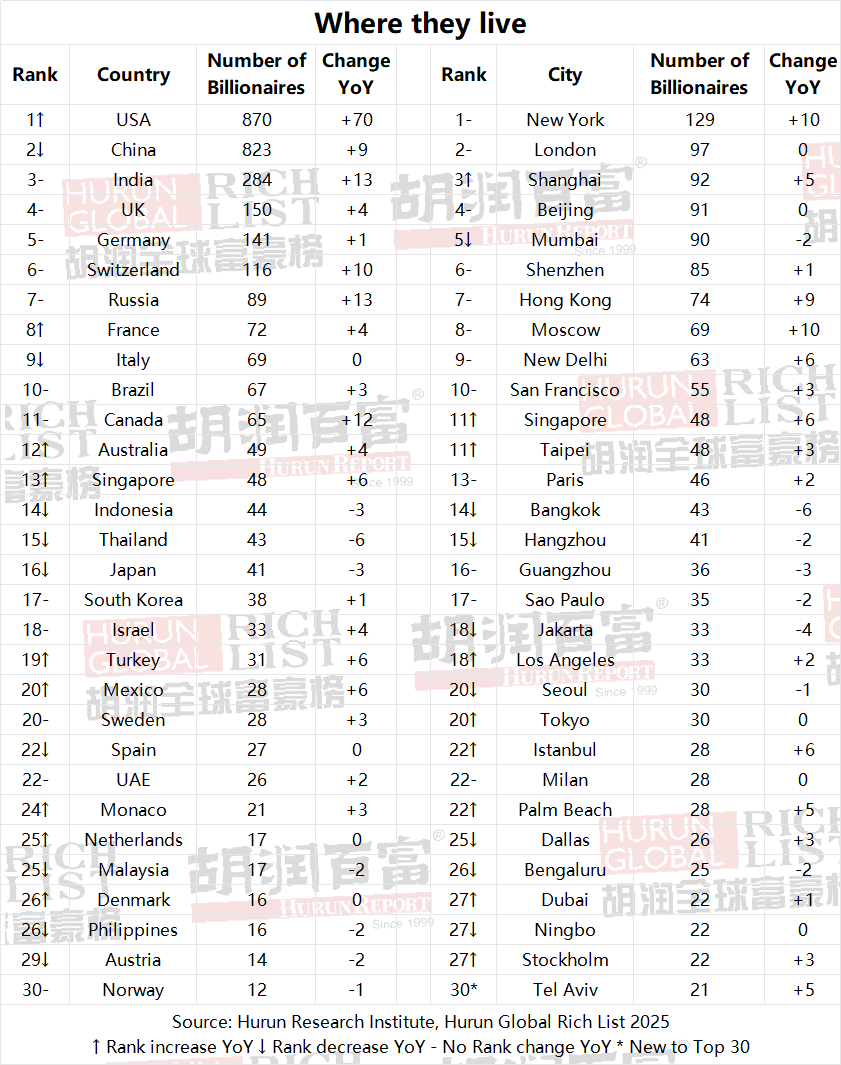

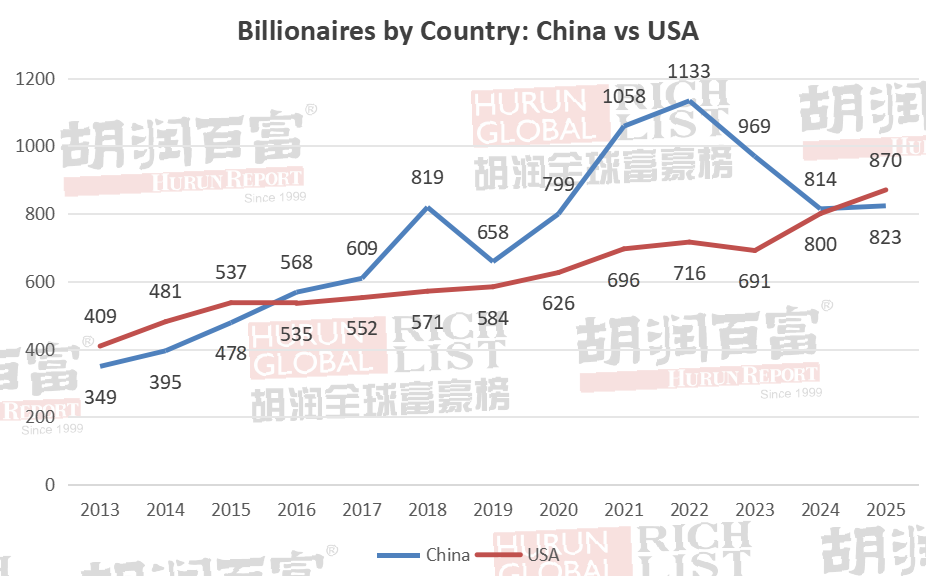

Where Billionaires Live

USA overtook China for the first time since 2016 as the world capital for billionaires, with 870 billionaires, up 70. China followed with 823 billionaires, up 9, reversing a two consecutive year drop in its number of billionaires. Together, these two countries continue to dominate the global billionaire landscape.

Ranked third, India is home to 284 billionaires, having added 13 new ones. Singapore jumped three places to 13th, overtaking Indonesia, Thailand and Japan in the process. Other countries that did well included Russia, Canada, Turkey and Mexico.

By city, New York is back again as the billionaire capital of the world, with London in second place.

Shanghai became the Asian Billionaire Capital for the first time.

Table 3: Where they live

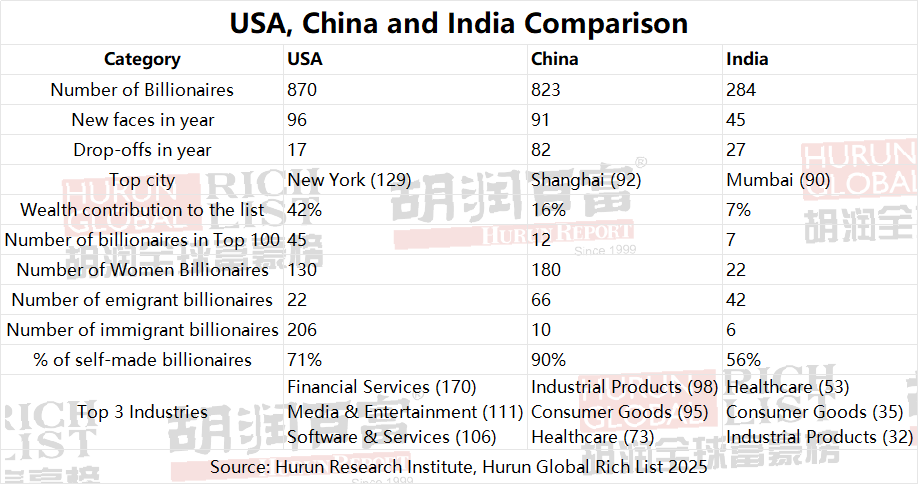

Comparison of Billionaires in China, USA, and India

China and India led the world for emigrant billionaires, whilst the US led with immigrant billionaires. China has the highest percentage of self-made billionaires, whilst India led with the highest percentage of family businesses.

Table 4: USA, China and India Comparison

USA: Regains Top Spot After 10 Years

The USA reclaimed its position as the country with the most billionaires, with 870 billionaires, after adding 96 new faces this year. With only 17 drop-offs, the country continues to showcase strong entrepreneurial growth. New York was the world’s billionaire capital for the second year running, home to 129 billionaires. Previously, NY had been the billionaire capital before Beijing overtook it in 2016.

American billionaires contribute 42% of the total wealth on the list, with 45 in the Hurun Top 100. The USA leads in immigrant billionaires (206), underlining its status as a global hub for wealth creation.

The country's dominant sectors include Financial Services (170 billionaires), Media & Entertainment (111 billionaires), and Software & Services (106 billionaires). The USA also has 130 women billionaires, second only to China, although mainly in inherited wealth.

China: Falls to Second Place in Billionaire Rankings

China slipped for the first time in ten years to second place, with 823 billionaires. The country recorded 82 drop-offs but added 91 new billionaires this year. Shanghai was China’s top city for billionaires, home to over 92.

China contributes 16% of the total wealth on the list and has the highest number of self-made billionaires (90%), including the lion’s share of self-made women billionaires. The leading industries are Industrial Products (98 billionaires), Consumer Goods (95 billionaires), and Healthcare (73 billionaires).

India: Continues Strong Growth with 284 Billionaires

India solidified its third position, adding 45 new billionaires this year to 284, triple that of ten years ago. While 27 dropped off, the country's billionaire count continued to grow. Mumbai remained the top city for billionaires, residence to 90 of them.

Indian billionaires contributed 7% of the total wealth on the list, with seven in the Hurun Top 100. The country had many emigrant billionaires (42), mainly to the US, but a low count of immigrant billionaires (6).

Dominant industries include Healthcare (53 billionaires), Consumer Goods (35 billionaires), and Industrial Products (32 billionaires). Gautam Adani saw a 13% surge in wealth, securing 18th place globally, while Mukesh Ambani remained India’s richest person.

Who’s Up?

1,958 saw their wealth increase, of which 387 were new faces.

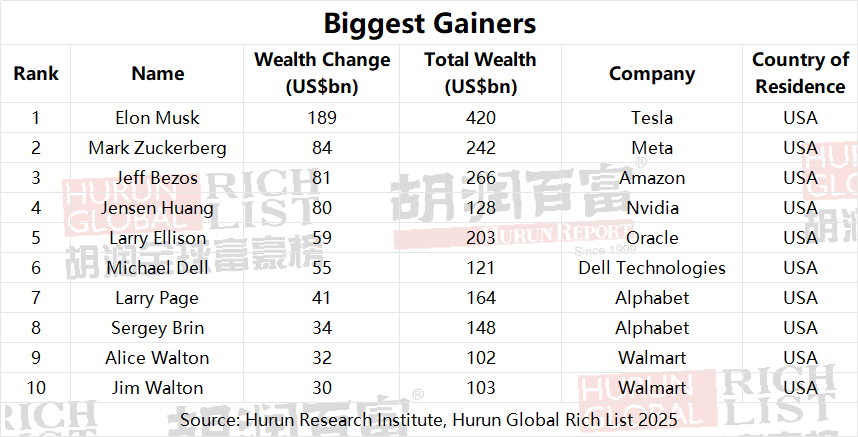

The biggest gainer of the year was Elon Musk, adding US$189bn to his total wealth, followed by Mark Zuckerberg, Jeff Bezos and Jensen Huang of Nvidia, who each added US$80bn or more.

The USA and China had the highest number of new entrants this year, with 96 and 91. India was third with 45. Industry-wise, Software & Services saw the most new additions with 47, followed by Consumer Goods with 36.

Table 5: Biggest Gainers

Table 6: Top 10 New Faces

And, Who’s Down?

1,260 saw their wealth decrease, of which 177 dropped off.

France made up three of the Hurun Top 10 biggest drops. Francoise Bettencourt Meyers saw the biggest drop, losing US$24bn, as L'Oreal's share price dropped. Bernard Arnault lost a further US$18bn, down now US$45bn since he was Number One in 2023. Gucci-owner Francois Pinault was down a further US$8bn, down US$21bn since his peak in 2021.

Mexico also had three of the ten largest drops. Carlos Slim Helu & family dropped by US$19bn, primarily due to a 9% decrease in the value of America Movil's shares. Daniel Servitje Montull & family of bread maker Grupo Bimbo was down US$9bn, as it faced challenges in its North America market and increased competition. Another Mexico billionaire Sara Mota De Larrea of mining company Grupo Mexico, valued at US$18bn last year, dropped off the list completely.

The Indian billionaire Mukesh Ambani saw a decline of US$15bn, as rising debt levels, reduced demand in key sectors, and increased competition for Reliance have further pressured its stock performance.

China’s Colin Huang Zheng was down US$17bn, as cross-border ecommerce giant Pinduoduo faced stiff competition in the US for its Temu platform. Zhong Shanshan lost US$8bn, after a spate of online attacks and intensifying competition in the bottled water market.

Table 7: Top 10 Drops in Wealth

Dropouts

Table 8: Top 5 Dropouts

Source of Wealth by Industry - Hurun Global Rich List 2025

By number of billionaires, Healthcare climbed into the Top Three, replacing Food & Beverages. Financial Services and Consumer Goods remained the largest sectors.

Table 9: Source of Wealth – Hurun Global Rich List 2025

Comparison of China and USA billionaires

The USA overtook China in billionaire numbers for the first time since 2016. China has now lost over 310 billionaires since its peak in 2022 with 1,133.

Chart 1: Billionaires by Country

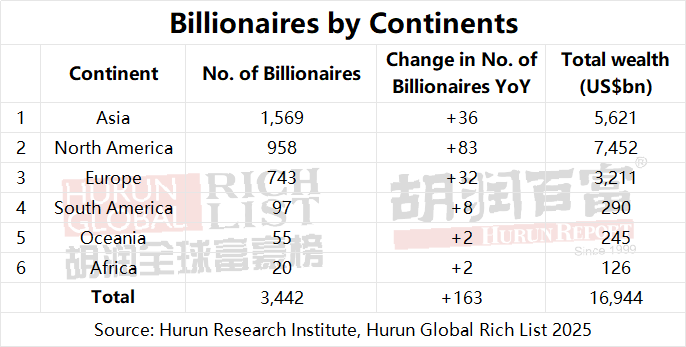

By Continent. Asia has just under half the world’s known billionaires. North America was the fastest growing continent.

Table 10: Billionaires by Continents

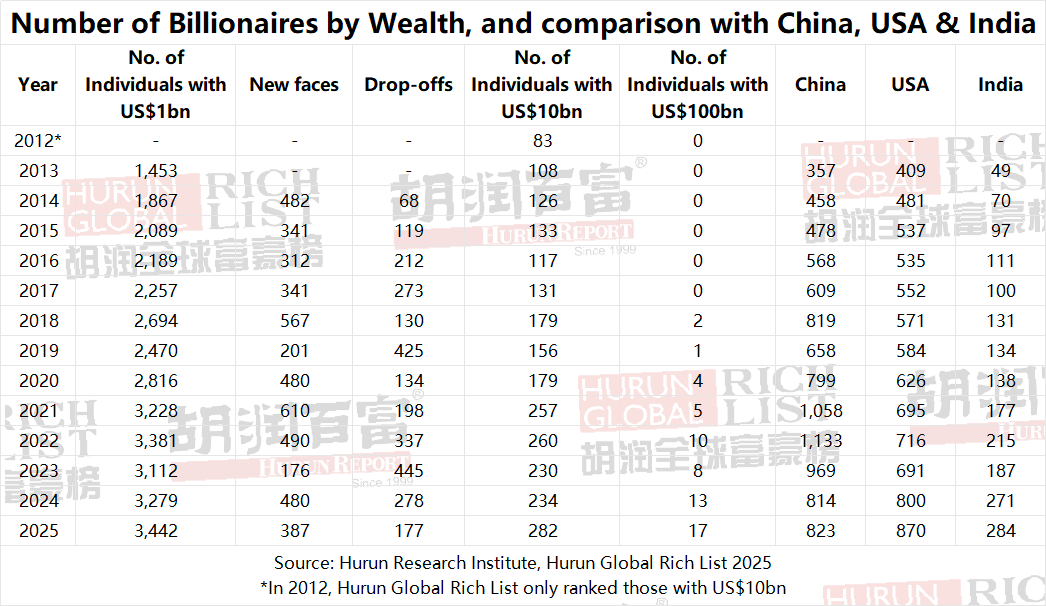

Number of Billionaires through the years

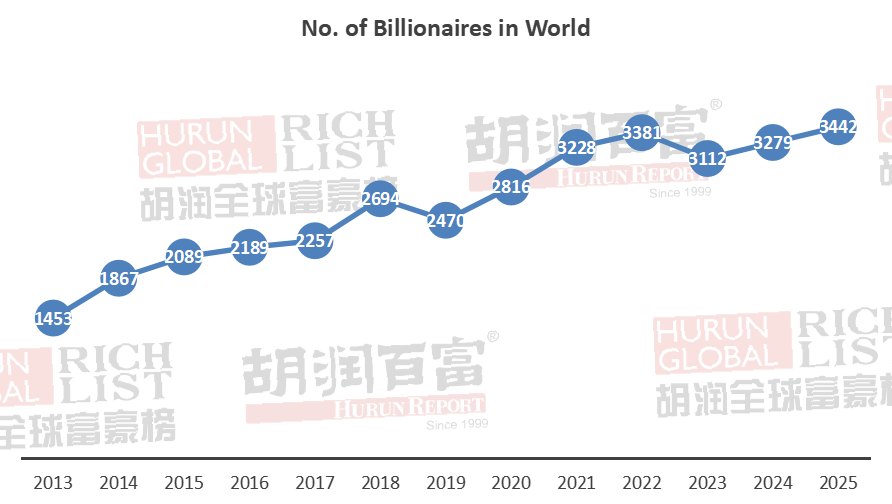

The total number of known billionaires hit a new world record of 3,442, more than double the 1453 of 2013, twelve years ago.

The ‘Ten-zero club’, those with US$10bn or more, more than doubled in a decade to 282.

Meanwhile, the ‘11-zero club’, those with US$100bn or more, has grown from zero to 17 in just eight years.

Table 11: Number of Billionaires by Wealth, and comparison with China, USA & India

Table 12: Stats – Cut-off through the Years

Chart 2: No. of Billionaires

Comparisons with the Top 10 Five Years and Ten Years ago

The cut-off to the Top 10 has doubled every five years. Five individuals who were part of the Top Ten a decade ago remain on the list today: Bill Gates, Warren Buffett, Bernard Arnault, Larry Ellison and Jeff Bezos.

Table 13: Five Years Ago – 2020 Ten Years Ago – 2015

Appendix 1 – Rest of World Countries

The UK has ranked fourth for two consecutive years. It has 150 billionaires with a combined wealth of US$605bn and is strong in sectors such as Real Estate (23 billionaires), Retail (21 billionaires), and Financial Services (18 billionaires). London is the most popular city, with 97 billionaires living there. Seventy-two saw their wealth grow, 48 fell off, and 11 joined the list. The average age of UK billionaires is 66.

Germany ranked fifth, with 141 billionaires and around 3% reduction in net worth to US$596bn. The most prosperous industries are Retail, with 22 billionaires; Healthcare, with 21 billionaires; and Food and beverages, with 19 billionaires. Munich is the top city, with 16 billionaires, followed by Hamburg, with 9. However, 65 billionaires saw their wealth decrease, leading to 1 drop-off. The average age of German billionaires is 66.

Switzerland was 6th in the world with 116 billionaires, with a total wealth of US$506bn. Geneva is the most popular city, with 14 billionaires living there. The industries that do well in Switzerland are Healthcare (25 billionaires), Consumer Goods (13 billionaires), and Investments (11 billionaires). Sixty-three billionaires saw their wealth grow. The average age of Swiss billionaires is 67, and Klaus-Michael Kuehne is the richest at US$32bn.

Russia retained 7th ranking globally with 89 billionaires (adding 13), with a total wealth of US$362.8bn. Metals & Mining (18 billionaires), Investments (11 billionaires) and Energy (10 billionaires) are the main industries. Moscow is the favoured city, with 69 billionaires living there. Remarkably, 49 billionaires saw their wealth increase, and there were 15 new entries. The average age of Russian billionaires is 61.

France has surpassed Italy to 8th place with 72 billionaires with a combined wealth of US$489.9bn. The most popular sectors among them are Food & Beverages, with 11 billionaires; Consumer Goods, with 10; and Construction & Engineering, with 8. Paris is the city with the most billionaires, with 46 in total. Bernard Arnault (US$157bn) is the wealthiest person. Twenty-eight billionaires saw their wealth increase, while 34 saw it decrease. 6 new people joined the billionaire list from France.

Italy has dropped to 9th in the rankings with 69 billionaires with a total wealth of US$205.1bn. The most popular sector is Consumer Goods, with 26 billionaires in it. Milan is the city with the most billionaires, with 28. The wealthiest person is Giorgio Armani, who has US$11bn in the Consumer Goods industry. The youngest billionaire, Clemente del Vecchio, aged 20, has a fortune of US$6bn. Renzo Rosso saw a remarkable 86% increase in wealth, reaching US$4.1bn. Moreover, there is only one new addition to the billionaire list from Italy.

Brazil ranked 10th in the world, with 67 billionaires who have a total wealth of US$176.8bn. The most popular sectors among them are Financial Services with 19 billionaires, Investments with 9, and Industrial Products with 6. 35 billionaires come from Sao Paulo. The richest person is David Velez, with US$11bn, linked to the industry giant Nu Holdings. The oldest is Maria Helena Moraes Scripilliti, aged 94, with a wealth of US$2.6bn.

Appendix 2: Self-made degree

Hurun Research’s bespoke measure of the degree to which billionaires are inherited or self-made. The scorecard is out of five, where one is inherited and not active in business, and five is self-made without help from parents. Hoogewerf said, “Many billionaires like to portray themselves as self-made but have inherited significant wealth from their parents.”

67% are Self-made, and 33% are inherited. China is the world’s engine when it comes to self-made billionaires.

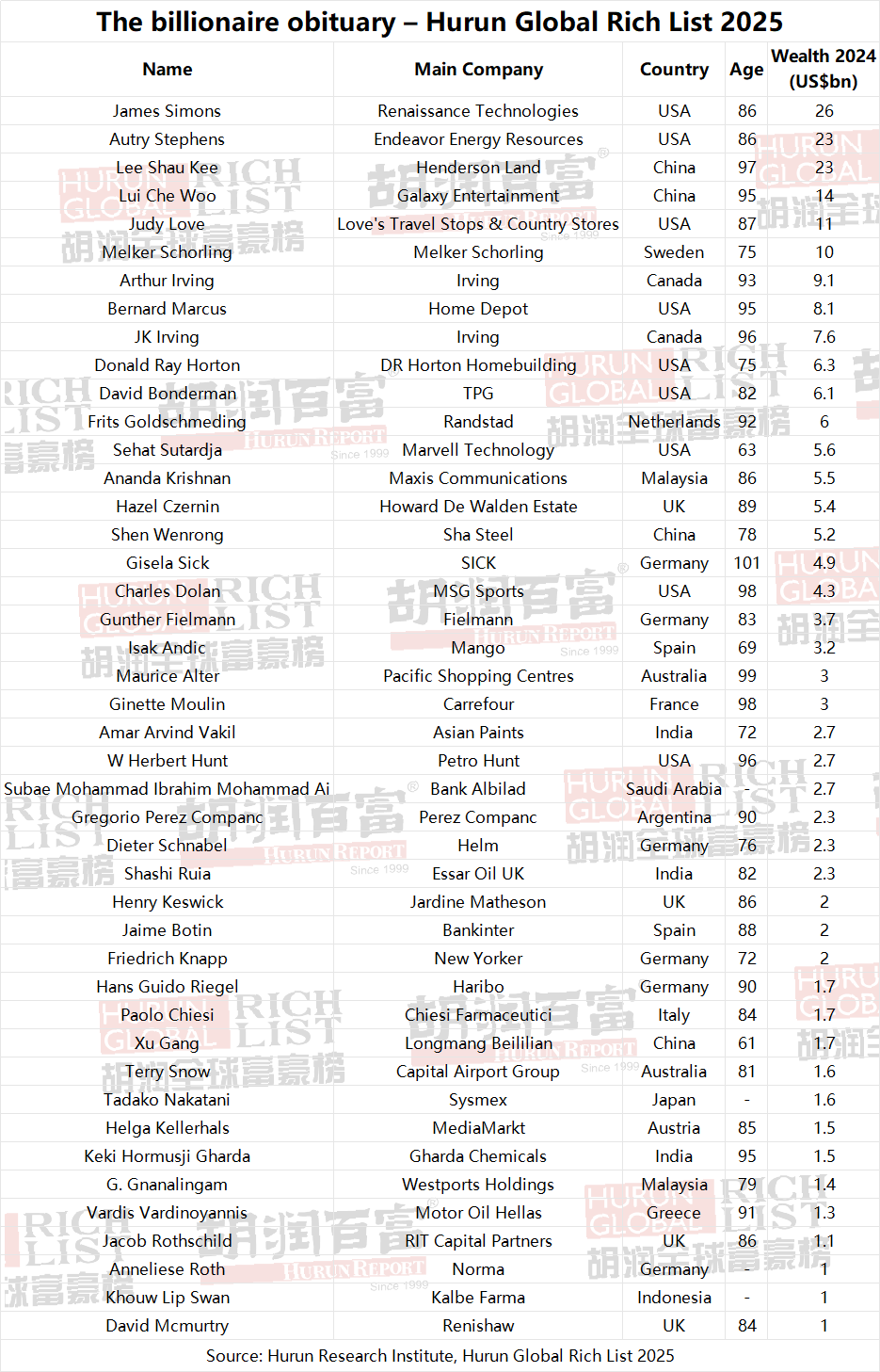

Appendix 3 – Deaths

44 billionaires died during the past year, the most in any one year since records begun.

Of the deaths listed, the youngest were Xu Gang of Longmang Beililian aged 61 and Sehat Sutardja of Marvell Technology, aged 63. 15 were over the age of 90, with Germany-based Gisela Sick & family (US$5bn) aged 101 and Pacific Shopping Centres Maurice Alter (US$3bn) aged 99.

Between them, they passed down US$233bn to family members.

Table 14: The billionaire obituary – Hurun Global Rich List 2025

Interesting Fact About Billionaires

Billion-dollar philanthropy. In 2024, Warren Buffett was the most generous, donating US$5.3bn to the Bill & Melinda Gates Foundation, which received over US$4bn, as well as the Howard G. Buffett Foundation, Sherwood Foundation, and NoVo Foundation, each receiving approximately US$285mn. In November, he pledged an additional US$1.2bn in shares to family foundations, furthering his commitment to donate over 99% of his wealth.

Michael Bloomberg of Bloomberg L.P. and former mayor of New York City, donated US$3.7bn to various causes, including the arts, education, the environment, and public health. Reed Hastings of Netflix, and his wife Patty Quillin donated US$1.1bn to the Hastings Fund at the Silicon Valley Community Foundation.

Malibu and Paris Estates. In 2024, James Jannard of Oakley, sold his Malibu estate for $210mn, one of the highest residential sales in California’s history. Laurene Powell Jobs, the widow of Steve Jobs, expanded her real estate portfolio with a $94mn purchase of a Malibu beach house in Paradise Cove. Amancio Ortega of Inditex, acquired a 10,000-square-metre office building in Paris for over EUR 200m. Located at 14 Halevy Street near the Opera, this marks one of the most significant real estate transactions in central Paris this year.

Divorces. Chey Tae-won of SK Group, divorced his wife, Roh Soh-yeong in 2024, with a settlement estimated at US$1bn, making it one of South Korea's largest divorce settlements. Tony Pritzker, the heir to the Hyatt hotel fortune and Jeanne Pritzker finalized their divorce in May 2024 after 33 years of marriage. The settlement details, including asset division, remain largely undisclosed.

Big acquisitions. In 2024, Mars has agreed to acquire Kellanova, the parent company of brands like Pringles, Eggo, and Cheez-It, for approximately US$35.9bn. This move is intended to boost Mars' presence in the snacking industry. Similarly, ExxonMobil acquired Pioneer Natural Resources for US$64.5bn, aiming to expand its footprint in the Permian Basin.

Guangzhou-based Ye Guofu of Miniso bought a 29% stake in supermarket Yonghui for US$900mn.

About Hurun Inc.

Promoting Entrepreneurship Through Lists and Research

Oxford, Shanghai, Mumbai, Sydney, Paris

Established in the UK in 1999, Hurun is a research, media and investments group, promoting entrepreneurship through its lists and research. Widely regarded as an opinion leader in the world of business, Hurun generated 8 billion views on the Hurun brand last year, mainly in China and India.

Best-known today for the Hurun Rich List series, telling the stories of the world’s successful entrepreneurs in China, India and the world, Hurun’s two other key series include the Hurun Start-up series and the Hurun 500 series, a ranking of the world’s most valuable companies.

The Hurun Start-up series ranks 3000 of the world’s unicorns and future unicorns with the Hurun Global Unicorns Index and the Hurun Future Unicorns Index, split into Gazelles (most likely to ‘go unicorn within 3 years) and Cheetahs (most likely to go unicorn within 5 years). Hurun also encourages founders with the Hurun Under25s, Under30s, Under35s and Under40s, presenting awards to founders who have built businesses worth US$1mn, US$10mn, US$50mn, and US$100mn, respectively.

Other lists include the Hurun Schools List, ranking the best highschools in the world, the Hurun Philanthropy List, ranking the biggest philanthropists, the Hurun Art List, ranking the world’s most successful artists alive today, etc…

Hurun provides research reports co-branded with some of the world’s leading financial institutions, brands and regional governments.

Hurun hosts regular high-profile events in China, India and the UK, as well as Paris, New York, LA, Sydney, Luxembourg, Istanbul, Dubai and Singapore.

For further information, see www.hurun.net.

For media inquiries, please contact:

Hurun Report

Porsha Pan

Mobile: +86-139 1838 7446

Email: porsha.pan@hurun.net

Grace Liu

Mobile: +86 136 7195 4611

Email: grace.liu@hurun.net

Hurun Report Disclaimer

This report has been prepared by the Hurun Report. All the data collection and the research has been done by the Hurun Report. This report is meant for information purposes only. Reasonable care and caution have been taken in preparing this report. The information contained in this report has been obtained from sources that are considered reliable. By accessing and/or using any part of the report, the user accepts this disclaimer and exclusion of liability which operates to the benefit of Hurun Report. Hurun Report does not guarantee the accuracy, adequacy or completeness of any information contained in the report and neither shall it be responsible for any errors or omissions in or for the results obtained from the use of such information. No third party whose information is referenced in this report under the credit to it assumes any liability towards the user with respect to its information. Hurun Report shall not be liable for any decisions made by the user based on this report (including those of investment or divestiture) and the user takes full responsibility for their decisions made based on this report. Hurun Report shall not be liable to any user of this report (and expressly disclaim liability) for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential losses, loss of profit, lost business and economic loss regardless of the cause or form of action and regardless of whether or not any such loss could have been foreseen.

Table 15: Top 100 - Hurun Global Rich List 2025

For the complete list of 3,442 billionaires in the world, see www.hurun.net